The State of Virtual Care

In China

INTRODUCTION

As the old saying goes, “necessity is the mother of invention” — meaning that when the need for something becomes paramount, we humans are forced to figure out how to adapt and do it. In the case of the COVID-19 pandemic, these uncertain times have forced healthcare systems around the world to figure out how to deliver healthcare more safely and remotely. This has created opportunities for innovation and the acceleration of many technologies such as Virtual Care. Nowhere has this been more evident than in China which has had to reimagine its healthcare delivery system as the pandemic has exposed many weaknesses in its delivery model. When we say ‘Virtual Care’ we are referring to both the delivery of healthcare services (via telemedicine and booking appointments online) and the digital assisted delivery of healthcare services (including augmented reality, virtual reality, mixed reality, AI, HMDs, etc.) This paper will explore the current state of Virtual Care in China by examining the following areas:

- The current healthcare landscape in China including the size and growth of the market, various healthcare challenges that can be overcome by Virtual Care, and the history of Virtual Care in China.

- The size and growth of the Virtual Care market in China including both telemedicine and various forms of virtual reality.

- Use cases of Virtual Care in both patient care and education of medical students and current healthcare professionals.

- Some of the advantageous elements that will allow Virtual Care in the Chinese healthcare market to proliferate.

- Current and future trends to be aware of with respect to Virtual Care in China.

THE CURRENT HEALTHCARE LANDSCAPE IN CHINA

Before we dive into Virtual Care in China, it is important to understand the prevailing landscape that affects the current climate for Virtual Care.

The Overall Healthcare Market in China

Currently, the healthcare industry in China is ranked the second largest in the world behind the United States.

Over the past five years, the market has grown at a consistently rapid rate. In 2019, the market had a 10 percent increase over the previous year as it reached RMB 7.82 trillion (US$1.1 trillion). In fact, the market has grown rapidly over the past five years as it has increased by more than a third of its size at an average of 11 percent growth year on year.

Despite this rapid growth, the market still remains quite undeveloped as China’s healthcare expenditures (which include pharmaceuticals, medical devices, distribution, hospital, pharmacies and insurance) only account for 6.57 percent of the country’s GDP in 2018 as compared to the United States where it reached 17.8 percent in the same year.4

Given the fact that COVID-19 will cause GDPs in many countries to contract in 2020, this will have a significant impact on the Chinese government’s total expenditures — of which a certain sum is apportioned to healthcare.

And as with many other countries, the healthcare industry in China has had to do a hard reset in 2020 as the COVID-19 pandemic has exposed many weaknesses in its healthcare services delivery model.

So, as China is now faced with rebuilding and redeveloping its healthcare system, its government has begun to establish its priorities for the next phase in healthcare transformation.

Responding to the challenges that the pandemic has brought has forced China to rethink and identify priorities within the healthcare system which has put items such as critical health infrastructure, public health promotion and digital health much higher on the list than if the pandemic had not occurred.

With that being said, the healthcare market in China offers many opportunities for growth, especially given that the Chinese government has recently identified several key initiatives to create long-term growth and innovation in the delivery of healthcare. And it is highly likely that healthcare will be featured even more prominently in the country’s 14th Five Year Plan (which covers 2021-2025) than it did in the preceding 13th Five Year Plan.4

Challenges Facing Healthcare in China

There are several challenges facing healthcare in China which will create even more opportunities for Virtual Care to thrive, including:

Access to Care

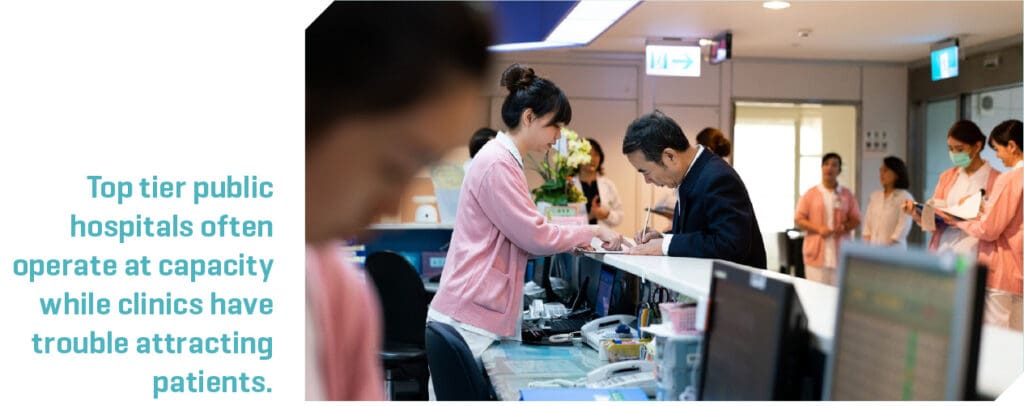

The recent pandemic has both intensified and exposed the omnipresent bottleneck within the healthcare system in China in the form of easy access to quality healthcare services. The structure of the healthcare system in China is a tiered one where: ∫ First-contact care is provided by smaller community health centers (CHCs) ∫ Specialist referral services are provided by Class 1 institutions In reality, the delivery of healthcare is an unbalanced one which sees more than 2,300 top tier public hospitals operating at capacity while the lower-tier hospitals and clinics have a hard time attracting patients.

This gives virtual healthcare platforms an opportunity to continue to grow in response to this unbalanced healthcare system to create an engagement model which is more patient-centric

in nature.

A Shortage of Physicians

It is a well-recognized fact that China is experiencing a shortage of physicians. The World Health Organization has reported that China only has 18 doctors for every 10,000 citizens, as compared to 26 per 10,000 in the United States and 36 per 10,000 in Australia. While other countries such as India have an even worse shortage with only 8 per 10,000, the government in China has made healthcare a priority.7

Inequality Between Urban and Rural Healthcare

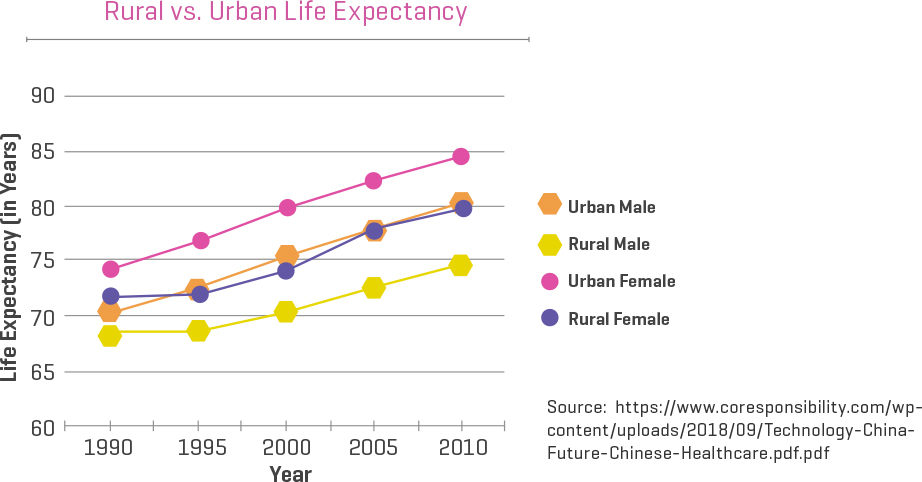

One of the most substantial health disparities that exists in China is the inequality between urban and rural healthcare. Those who live in rural areas have a significantly lower life expectancy than those who live in urban areas as seen in the figure.

One significant issue that those who live in rural areas face is access to care. There are fewer than half as many healthcare institution beds and licensed physicians in rural areas as there are in urban areas.

In fact, in some isolated areas where there are no hospitals and only small township health centers, there are only 1.27 available beds for every 1,000 residents.5

Cost of Care for Rural Patients

Another issue that rural patients have to deal with is the fact that they are more significantly impacted by medical costs than their urban peers.

While the New Rural Cooperative Medical Scheme does cover most rural residents, it only reimburses a partial number of outpatient services and the amount reimbursed varies by county.

And those rural households who have members with chronic conditions have a 1.5 times greater chance than the average population of having to deal with Catastrophic Healthcare Expenditures (CHEs), which are unexpected medical costs that can send patients into poverty.5

An Aging Population

As we have seen above, China’s enormous population base has already put an incredible strain on their medical resources. And at the same time, they have dealt with problems of comparatively unbalanced economic development and an uneven distribution of medical resources.

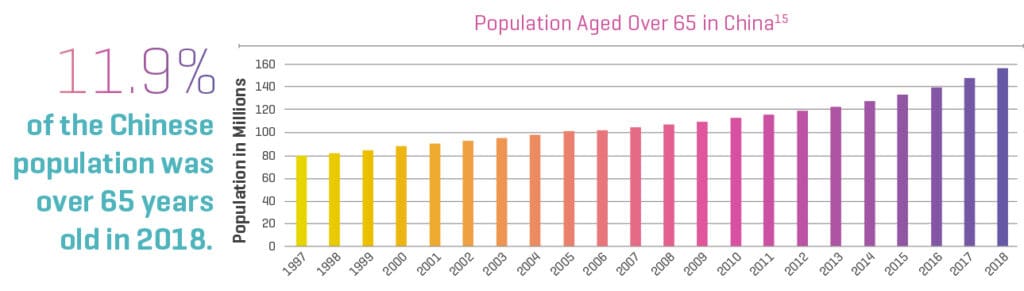

To add insult to injury, the population in China is aging which has put an immense amount of pressure on younger generations to care for older ones. According to the United Nations, any country who has 65-year-old people and older account for more than 7% of their total population is considered an aging society.6

According to data released by the Chinese Bureau of Statistics (NBS), 11.9 percent of the Chinese population in 2018 was over 65 years old.6

As the elderly population in China enters a period of health decline, this puts even more pressure on a strained healthcare system as they are much more likely to increase the market demand for medical resources.

History of Virtual Care in China

Virtual Care in China started relatively late. Back in 1988, the PLA General Hospital performed a remote case discussion of neurosurgery via satellite with a hospital in Germany, which, in a modern sense, was the first Virtual Care activity in China. Over the past few years, the Virtual Care industry in China has seen a rapid progression thanks to:

- The evolution of computer technology

- Communication technology

- Digital medical technology

- Hospital information systems

- A series of core technologies in Virtual Care

- The increasing consumerism of healthcare

- The growing chronic disease burden

Putting the impetus provided by the COVID-19 pandemic aside, the Virtual Care market in China was slated to reach over 59 million users by the end of 2020 and is expected to grow by more than 20x to an expected market size of $28 billion by 2026.13 According to Oliver and Mercer who launched a study in 2019 called Health on Demand, this growth will continue as Asian consumers will be one of the leading regions in the world for digital health as:13

- Respondents from Asian countries (India, China, Indonesia, and Singapore) are more excited by digital health (78 percent versus 66 percent globally)

- 61 percent of Chinese consumers consider themselves “early adopters” of new technology (versus 38 percent globally)

- Lower barriers to adoption, with a higher proportion of the respondents willing to share personal information for healthcare purposes (94 percent versus 85 percent globally)

The COVID-19 pandemic has only added fuel to the fire in terms of global demand for Virtual Care. Many Chinese Virtual Care platforms and service providers have seen a spike in adoption and increased use throughout the pandemic. For example, Ping An Good Doctor, China’s largest Virtual Care platform, say newly registered users increased 10x from early January 2020 to the middle of February with their average daily consults nine times higher than usual6. Similarly, other platforms such as Dingxiang and HaoDF saw triple-digit growth during the same period. As we have seen during the pandemic, Virtual Care is no longer a fringe technology and is now seen as a sustainable delivery channel for traditional healthcare providers.

What is true is efficient Virtual Care services necessitate the development of multiple technologies. Some of these include big data, AI, and 5G technologies to foster appropriate clinical action, coordination and communication between patients, Virtual Care platforms and physicians. As fortune would have it, back in 2019 China rolled out one of the largest 5G networks in the world. This has permitted increased expediency and capability for real time coordination in Virtual Care and digital health.

An example is Huoshenshan Hospital where 5G was a critical element in their “remote consultation platform” which connected physicians in real time with colleagues in Beijing. It has also enabled public health initiatives such as virus tracking and epidemic monitoring.

While the global COVID-19 pandemic has had a profound impact on healthcare in terms of creating immense pressure for the industry to increase capacity, protect its workers, and serve its citizens in various stages of anxiety and disease, it has also created opportunity. That opportunity has come in the form of Virtual Care supplementing the strained healthcare delivery system amidst governments having mandated people stay home.

Traditional Chinese Medicine

Traditional Chinese Medicine (TCM) is an ancient practice of health and wellness that has been practiced in China for thousands of years. While Western medicine is generally focused on treating disease, TCM takes a different approach by looking at your entire well-being. The ancient system of TCM has evolved over thousands of years and those who practice it use many different mind and body practices (such as acupuncture, cupping, meditation, Tai Chi, etc.) as well as herbal products to deal with health issues.

The TCM Market in China

The Chinese are believers in TCM due to its long history of traditions, faith, usage and associated anecdotes. They prefer TCM remedies over Western remedies as they believe that there are less side effects with TCM as well as a recuperative effect on their body. The TCM market has been growing rapidly since the late 1990s. Interestingly, the net yield and profits for TCM are higher than other segments of the country’s healthcare industry. It is believed that the total market for TCM in China will reach €96.2 billion by 2025.1

The Globalization of TCM

According to a white paper on the development of traditional Chinese medicine (TCM) in China:

“Promoting the globalization of TCM, Traditional Chinese medicine has been spread to 183 countries and regions around the world. According to the World Health Organization, 103 member states have given approval to the practice of acupuncture and moxibustion, 29 have enacted special statutes on traditional medicine, and 18 have included acupuncture and moxibustion treatment in their medical insurance provisions.” 1

What is also interesting is that many well-known US healthcare systems such as the Cleveland Clinic, Johns Hopkins and the Mayo Clinic offer several TCM practices such as cupping, acupuncture, and some herbal treatments as part of an integrative medicine approach.

Another positive sign for the globalization of TCM is that for the first time ever, the WHO’s governing body, the World Health Assembly in its 11th revision of the International Statistical Classification of Diseases and Related Health Problems (ICD-11) included details regarding traditional medicines. Historically, TCM has been excluded from the ICD system, so the fact that it was included in its latest edition is a big deal for ICD and a major milestone for TCM. It is important as it gives a more accurate picture of the true situations of member states of the WHO in terms of how they practice healthcare.

Additionally, it is important as:

“It is a critical step not only because TCM may take this chance to be developed further among WHO member states, but also because TCM should benefit from improved service levels, education, research, and regulation. In addition, this initiative contributes to the progressive reform of the world healthcare system, from global extension of TCM to the integration of TCM with multiple Western medicine-based disciplines. People all over the world will benefit.” 3

However, despite the fact it is booming in the market, its safety and efficacy are still being highly scrutinized.

Issues with TCM

Despite TCM’s growing market and globalization there are still many who question its efficacy and scientific background. This has meant that China is the only country in the world that has both modern medicine and TCM practiced in the healthcare system.1 According to a paper entitled “Traditional Chinese Medicine (TCM) — Does its contemporary business booming and globalization really reconfirm its medical efficacy & safety?”, the reason for the skepticism of TCM is due to the fact that:

“… most of TCM practices have seldom been verified by randomized controlled trials (RCT). The critical puzzles are these aspects of TCM’s concepts on the human body and health. Its concept about diseases cannot be explained by modern medical theory. For example: it is difficult to prove the concepts of Yin (Negative) and Yang (Positive), Qi (Gas or Energy), Six Exogenous Pathogenic Factors (Six Yin)…All these concepts could be ancient people’s philosophical thinking or imagination, which seem to be “right” but cannot be testified by any scientific approach.” 1

In other words, many traditional physicians would like to see proof that something is safe and effective before they recommend that you try it.

Virtual Care Usage in TCM

As far as Virtual Care usage in TCM is concerned, a great example comes from Maizhiyu, a Chinese telemedicine startup which has designed a system that allows TCM practitioners to conduct pulse diagnosis remotely.

Pulse diagnosis is a fundamental diagnostic technique used in TCM by capturing and analyzing different health signals from the patient’s pulse.

Their system provides TCM access to ordinary patients by leveraging smart devices and the internet.

It has been long believed that it is relatively impossible to design a device that is able to provide pulse diagnosis, let alone via telemedicine.

This revolutionary technology has allowed the firm to complete an angel round of financing from Fu Dongping, who is an angel investor from Meituan Dianping, which owns a group buying and consumer review portal.

MARKET SIZE AND GROWTH OF VIRTUAL CARE IN CHINA

Now that we have a good baseline understanding of the current healthcare landscape in China, let’s take a deeper dive into Virtual Care in terms of the size and growth of the market with respect to Telemedicine and Virtual/Augmented Reality.

Telemedicine Market in China

Prior to the COVID-19 pandemic, most consumers in China visited physical healthcare institutions to have their healthcare needs met. While Virtual Care was an increasingly talked about concept, the actual telemedicine penetration rate was relatively low.

A survey completed by Bain & Company in 2019 effectively confirms this, as only 24 percent of respondents in China had used Telemedicine services.4

However, as noted earlier, one of the inevitable side effects of COVID-19 has been a rapid widespread adoption of Virtual Care technologies in two main areas:

- The delivery of healthcare services (remote monitoring of patients booking appointments online, and Telemedicine services)

- The digitally assisted delivery of healthcare services (AI, machine learning to aid in diagnostics and treatment, Augmented Reality and AR surgeon training and robotic and AI assistance)

Something interesting occurred during the pandemic in that the country’s National Health Commission (NHC) accelerated the adoption of Virtual Care by promoting its use to reduce population movements and decrease the risk of infection. This created exponential growth in the user base as well as engagement of China’s Virtual Care platforms.

A recent study by Global Market Insight is predicting that the compound annual growth rate (CAGR) of the global Telemedicine market will grow by 19.2% by 2025, expanding from its existing valuation of USD $38.3 billion to USD $130.5 billion. Likewise, China is expected to grow at 23% CAGR by 2025. This surge will primarily be driven by international telecommunication network developments, market opportunities for those lacking easy access to healthcare or in rural areas, and the ongoing integration of IT and healthcare market sectors.7

In terms of market size, by April 2019 there were 45 million users of online Telemedicine services in China which accounted for industry penetration hitting 6.6%. In fact, by the start of 2020, due to the COVID-19 crisis, the penetration rate rose by 2 percent year over year.6

This trend is expected to continue to increase as users of Telemedicine apps and websites are no longer solely patients from first-tier cities, but also those in second and third-tier who are starting to use Telemedicine platforms. The main user demographic are those under the age of 35, however, given the aging population in China it only stands to reason that Telemedicine companies will soon focus on this segment of the market.

Global and Chinese Market for Virtual Reality

Amidst the COVID-19 pandemic, the global market for Virtual Reality in healthcare in the year 2020 is estimated to be US$336.9 million and it is expected to achieve US$2.2 billion by 2027 while growing at a CAGR of 30.7 percent during that time.8 The Chinese market for Virtual Reality in healthcare is expected to hit a projected market size of US$369.4 million by the year 2027 while growing at a CAGR of 29.6 percent over the same period.8

VIRTUAL CARE USE CASES

In this section, we will explore some of the more interesting Virtual Care use cases that we have seen in China.

Ping An Good Doctor Responds to the COVID-19 Pandemic

The largest mobile telemedicine platform in China, Ping An Good Doctor saw demand for its services skyrocket during the pandemic as it had nearly 831,000 medical consultations daily in the first half of 2020, which was up 26.7% year on year.

According to Jessica Tan, Co-CEO of Ping An Group:

“A lot of consumers with small illnesses don’t want to go to hospitals for fear of further infection … I think (demand for telemedicine) is going to continue accelerating,”14

The company provides a suite of end-to-end services for its patients including 24-hour online consultations, referrals, prescriptions, second opinions and medication deliveries. All of these services are supported by a full-time medical team as well as a proprietary AI-based medical system.

Using VR to Teach Acupuncture at the Beijing School of Chinese Medicine

Students at the Beijing School of Chinese Medicine wear goggles and hold gaming controllers as they learn about meridian pathways and acupoints. Moving dots are used to illustrate the 12 major pathways as the organs of the body, as well as its nerves, muscles, and other human tissues around them are shown in various different colors. This innovative program, which started in May, is teaching its students acupuncture using Virtual Reality (VR). According to their professor, Cheng Kai, the system they are using, created by Augmented Intelligence in the US, is able to be used both on campus and remotely:

“There’s a very high level of requirement for precision in acupuncture teaching. For example, there’s an acupoint called jinming, which is situated very near the optic nerve,” Cheng says. “Needling this acupoint carries a certain danger [if the practitioner does not grasp the precise depth and angle for the insertion of the needle]. The VR learning system is a big improvement on traditional acupuncture teaching based on two-dimensional images and the use of real people as models. “The system is stored in cloud servers. Using the goggles, students can do self-learning and pre-lesson revision. We are applying to the central government to set up a lab based on the system. Our university is the leader among all the Chinese medicine universities across the country.”9

Wearable Computing Enables Virtual Care during the Pandemic in Wuhan

In January 2020, Wuhan was in lockdown amid an increasing rate of COVID-19 hospitalizations. Seattle-based Hippo Technologies, Inc., a leader in wearable computing in healthcare, provided their Hippo Virtual Care platform with head-mounted tablet to establish the first Physician Control Center use case allowing specialist physicians to collaborate remotely through the video capabilities of Hippo headsets to guide caregivers in the treatment and care of patients in ICUs and isolation zones. Hippo’s hands-free, voice activated headsets can be worn with Personal Protective Equipment and provide a “through the eyes of the user” viewpoint, enabling clinicians to communicate and videoconference in real time with remote colleagues during patient examinations, procedures, consultations and rounding. Hippo Virtual Care has now been used in more than 30 hospitals across China.

Helping Kids with Autism in Shanghai

By using Virtual Reality technology to increase their perception of people as well as their surrounding area, more than 1,000 children with autism in Shanghai have experienced positive results. The technology does this by immersing the kids in interactive games. As Zhai Guangtao, co-developer of the system and a professor at Shanghai Jiao Tong University says:

“The features of VR, such as users being immersed and interactive, inspire imagination and perfectly fit what children suffering from autism need…VR can be an ideal approach to assist in intervention and treatment for these kids.”10

The idea was devised jointly by Shanghai Invision Digital Technology Co., as well as experts at the Shanghai Mental Health Center and the university’s School of Electronic Information and Electrical Engineering.

According to Pan Geng, the co-founder of Invision, using VR represents a more life-like environment and promotes a sense of focus:

“Autistic children are easily distracted. But when wearing a VR helmet, most of them are highly interested and immersed in the three-dimensional pictures and sound.” 10

Using Mixed Reality to Teach Anatomy

In May 2017, Microsoft launched a product called HoloLens in China, which is an Augmented Reality device which it describes as Mixed Reality Smart Glasses.

Initially developed several years earlier as a video gaming device, it is being marketed in China as a tool that can help medical students leverage digital content while learning anatomy as well as helping physicians create surgical plans.

Even though Microsoft has not published its first-year sales of the devices, according to HoloLens Strategic Director, Jared Anderson, it is being used in more than 100 top-tier Chinese hospitals as a tool to conduct medical training, design surgical plans, and assist in navigating surgeries.

A great example of using the technology came in January when surgeons who were operating at Bortala People’s Hospital in Xinjiang Uygur Autonomous Region of China leveraged the technology to conduct a remote consultation with colleagues who were at Wuhan Hospital in Wuhan, China as well as those at Virginia Polytechnic Institute and Virginia Tech University in Blacksburg, Virginia. After donning the HoloLens device, the physicians stationed at the three remote locations simultaneously viewed MRI and CT scans of the patient in 3D. Based upon what they saw they were able to offer guidance in real time to surgeons in the operating room.

Treating Drug Addiction with VR

This use case involves Shanghai centers using VR to reveal the extent of addiction by drug users as well as the kinds of treatment they need to turn their lives around.

While the centers in Shanghai were not the first in China to use VR (some rehab facilities in the eastern Chinese province of Zhejiang have used them last year), they were the first to apply the technology with respect to eyeball movement tracking science.

The ability to read the way a patient’s eyeballs move with respect to certain images gives staff a better idea as to whether the addict’s gaze is focused squarely on the visceral “educational” images of drug addicts that she or he is asked to watch.

Being able to track an addict’s eyeball movement also provides the staff additional information that can be used to validate the self-evaluation they are mandated to fill out; many have been known to prevaricate with respect to the severity of their drug dependency so that they can get out of the program quicker.

“In the rehab center we see those awful pictures of drug addicts through VR helmet several times a month, as part of our education here,” Wu told the Post. “I really abhor drugs now.”11

While it is unclear how many addicts have been exposed to the VR program in China, the number is estimated to be substantial as the five centers in Shangai and the one at Qingdong treat 1,800 male addicts alone.

A FAVORABLE ENVIRONMENT FOR VIRTUAL CARE TO THRIVE

There are numerous factors from a state, regulatory, customer acceptance and technological perspective that have created a favorable environment for Virtual Care in China including:

Healthy China 2030

In 2016, the Chinese government launched a program called Healthy China 2030, which is the nation’s first long-term health initiative since 1949. Having a current government mandate that prioritizes healthcare can only be seen as a positive move for Virtual Care and AI, as they are making it possible to increase the number of Chinese citizens who are able to be treated.

NHSA Launches Electronic Medical Insurance System in 2019

Fast forward to 2019 when the National Healthcare Security Administration (NHSA) rolled out the electronic medical insurance system which was created to regulate prices and insurance policies, allowing for online-based healthcare services to be covered by China’s medical insurance system.

Beginning in August 2019, patients were able to access diagnostics and prescription services from healthcare providers via WeChat and Alipay without having to bring along any medical insurance ID cards, which helped to promote the widespread adoption of Virtual Care.

Provincial Government Support Follows in May 2020

The provincial governments got in on the act in May 2020 when the NHC encouraged them to create their own online regulatory platforms in an effort to regulate and oversee online healthcare providers and to speed up the market access of internet-based healthcare. This was supported by a notice that took effect in August 2020, which officially launched the use of electronic certificates for healthcare institutions, nurses and doctors.

Chinese Consumers More Open to Virtual Care

A survey conducted by Bain & Company revealed that Chinese patients are much more open to, and expectant of, accelerated uses of Virtual Care services within the next five years. While the results of this survey apply specifically to telemedicine which saw an exponential growth of over 164 percent, there is also a greater acceptance of other digitized healthcare services across the continuum such as long-term sickness management, digital healthcare records, on-demand services and various insurance apps.4

The key takeaway for digital companies is that new opportunities in the Chinese market are there for the taking for those who want to establish and/or solidify their position.

MedTech (medical technology) and SaaS (software as a service) companies are primed to team up with offline healthcare providers to move into more innovative business-to-consumer (B2C) healthcare delivery models to enable more all-inclusive and complete care for patients.

Chinese Government Commitment to Virtual Reality

The Chinese Ministry of Industry and Information Technology released a document called “Guiding Opinions of the Ministry of Industry and Information Technology on Accelerating the Development of Virtual Reality Industry” which outlined how China intends to not only commit to VR, but actively support the rapid growth of the digital health ecosystem and become a world leader in Virtual Reality.

This helps us to understand the long-term plans of the Chinese government with respect to VR and how they want to push this technology from the top as they believe it can be key tool in the digital transformation of the country.

In terms of VR healthcare, the guidelines can be summarized as followed:

“Accelerate the application of Virtual Reality technology in medical teaching, training and simulation exercises, surgical planning and navigation, and promote the improvement of medical service intelligence.

“Promote the application of Virtual Reality technology in psychological counseling, rehabilitation nursing, etc., explore the complementary and perfection of Virtual Reality technology to existing medical treatment methods, develop Virtual Reality home care, online diagnosis and treatment, virtual visit service, and improve the level of Telemedicine.”12

To fulfill this plan, the Chinese government identifies eight promotion measures:

- Policies — create policies that ensure industries do their part to help VR flourish. For example, financial institutions providing credit to enable the growth of the VR ecosystem.

- Support of local governments — China is huge, so it is critical that local governments do their part to ensure the plan is applied at a local level.

- Creation of VR applications — Organizations will be urged to build useful and high-quality VR experiences and use cases and businesses will be urged to use VR. Finding business models and application models that are able to be promoted and replicated is also critical as it means growth for the entire VR ecosystem.

- Building a VR industrial ecosystem — Promotion of a VR ecosystem where companies work together with respect to serving the key aspects of the technology is critical.

- Endorsement of industrial brands — Those companies who create superior products should be endorsed in China as an example for others to demonstrate how well China performs in VR.

- Creation of talent — This kind of ambitious plan needs a significant amount of talented people. The education system needs to be able to train people who have the skills to enable VR to move ahead in all critical areas.

- Creation of industry organization — All of the government entities need to support the cooperation for those involved to establish standards to enable the VR ecosystem to move forward as a whole.

- Encouraging international exchanges and cooperation — The idea, while growing the Chinese VR ecosystem and having control over it, is to also collaborate with foreign companies with the goal of making VR better. Of course, this can also result in Chinese companies selling their products overseas.

Rolling Out 5G Technology

The term “5G” stands for the fifth generation of wireless transmission technology, which is expected to have an enormous impact on many in our society, including those in the healthcare industry.

One of the greatest improvements of 5G technology in comparison to 4G and 4G long-term evolution (LTE) is that 5G offers a data transfer rate of up to 10 Gbps which is a 10x to 100x improvement. In addition to speed, another improvement of 5G is low-latency; the latency in the 5G era is <1 ms which is basically equivalent to zero data response time in the real world. The significance of this in the healthcare technology world is that an “intelligence network” is able to establish “real-time” interactivity with respect to massive medical equipment and wearable devices for patients, with a cloud service.

In 2019, China rolled out one of the world’s largest 5G networks. This has created increased expediency and capability for real-time coordination using Virtual Care. For example, 5G was instrumental for the “remote consultation platform” used by physicians at Huoshenshan Hospital when they connected with colleagues far away in Beijing in real-time.

Another example of the power of 5G came in early 2020 during the COVID-19 pandemic. With the aid of 5G technology, Zte and Sichuan Telecom enabled the West China Hospital of Sichuan University and Chengdu Public Health Clinical Medical Center to complete remote consultation of two COVID-19 cases using 5G for the first time.

The use of 5G technology has expanded the application of Telemedicine to include remote surgery and ultrasounds, virtual ward rounds, virtual monitoring, virtual consultation and virtual first aid, among others.

MAJOR VIRTUAL CARE PLAYERS IN CHINA

Some of the major players in the Virtual Care industry are:

JD Health // A relatively unknown player to all but a limited number of healthcare providers and private patients, the subsidiary of e-commerce platform JD.com, JD Health earlier this summer saw 1.6 million people tune in for a streamed talk given by one of the platform’s renowned cardiologists.

Ping An Good Doctor // As of September 2019, the platform run by a major insurer already had 300 million registered user who used the service to book appointments with hospital specialists rather than engage in online appointments.

Dingxiang Doctor // Their real-time heat tracker was able to track COVID-19 patients all over China while attracting 1.5 billion views.

Alibaba’s Ali Health and Tencent’s WeDoctor // These are two companies who currently dominate the industry and have been able to onboard new users via free consultations and online clinics aimed at created goodwill and sign-ups.

These large companies are spending wisely to attract new customers and to mark their territory on the sector. Attracting new customers, particularly those in older communities who would not typically consult their smartphone when sick, will no doubt prove to be lucrative in the longterm.

CURRENT AND FUTURE TRENDS

One of the biggest reasons for businesses to explore the benefits of Virtual Care now is that the technology is only just maturing.

Some people’s experiences in the past, particularly with AR and VR may have been a bit clunky, but the current state sees both the hardware and software improving every day, getting both more sophisticated and engaging, as well as easier to use. The vast improvement in connectivity (see the section on 5G above) has effectively resulted in a broad range of use cases opening up.

Headsets including Head-mounted Displays, Smart Glasses and VR devices are now much lighter, more cost-effective and are more comfortable to wear, while vast improvements are being made in terms of the field of view resolution and voice activation software.

As we discussed above, the increased speed delivered by 5G networks will result in reduced latency which will provide a much improved, smoother, and richer user experience for both patients and providers.

These high-speed networks will also benefit headsets as they will no longer have to rely on built-in processing or storage, which will reduce costs while enabling more user-friendly designs. Rather than existing on the headset itself, that storage and processing will instead be pushed to the cloud.

Another emerging trend is that of haptics which is the use of touch sensation. Applying it to VR specifically permits users to touch objects in the virtual world and receive feedback. The idea is to allow users to ‘feel’ the interactions they have which enhances the virtual experience. Haptics can be applied to many industries including healthcare to support user interaction with digital interfaces much more seamlessly.

CONCLUSION

In this paper, we discussed many factors that will enable Virtual Care to flourish and thrive in China in the years to come. The current healthcare market in China is second only to the United States in size, and is growing at a rapid rate – increasing by more than a third at an average of 11 percent growth year on year over the past five years. Despite this rapid growth, however, the Chinese government has faced numerous healthcare challenges including: limited access to care, a shortage of qualified physicians, inequalities between urban and rural healthcare, an increased cost of care for rural citizens, and an aging population. Many, if not all, of the challenges above can be met by leveraging various aspects of Virtual Care. In fact, the market has already started to speak as the use of Telemedicine in China is expected to grow at 23% CAGR by 2025 while the use of Virtual Reality in healthcare is expected to grow at a CAGR of 29.6 percent between 2020 and 2027.

There are several market drivers that are causing Virtual Care to thrive in China, and we believe this trend will accelerate even more in the near future, including:

- The Chinese government’s launching of a program called Healthy China 2030, which is the first long-term health initiative since 1949.

- The NHSA rolling out the electronic medical insurance system in 2019 to regulate prices and insurance policies which allowed for online-based healthcare services to be covered by China’s medical insurance system.

- The NHC encouraging provincial governments to create their own online regulatory platforms in May 2020 in an effort to regulate and oversee online healthcare providers and to speed up the market access of internet-based healthcare.

- Chinese patients being much more open to and expectant of accelerated uses of Virtual Care services within the next five years.

- The Chinese Ministry of Industry and Information Technology releasing “Guiding Opinions of the Ministry of Industry and Information Technology on Accelerating the Development of Virtual Reality Industry” which outlined how China wants to commit to becoming a global leader in VR.

- China rolling out one of the world’s largest 5G networks in 2019. This has created increased expediency and capability for real-time coordination in Virtual Care.

These developments are creating an environment conducive to the rapid proliferation and growth of the Virtual Care industry in China for the foreseeable future.

References

- https://www.sciencedirect.com/science/article/pii/S259009861930003X#bb0005

- https://www.webmd.com/balance/guide/what-is-traditional-chinese-medicine#3

- https://pubmed.ncbi.nlm.nih.gov/31933225/

- https://www.china-briefing.com/news/china-investment-outlook-telemedicine-digital-healthcare-industry/

- https://www.coresponsibility.com/wp-content/uploads/2018/09/Technology-China-Future-Chinese-Healthcare.pdf.pdf

- https://daxueconsulting.com/telemedicine-in-china/

- http://pacificprime.cn/blog/why-chinas-telemedicine-market-is-expected-to-skyrocket/

- https://apkmetro.com/covid-19-gives-boost-to-chinas-telemedicine-industry/

- https://www.reportlinker.com/p05336795/Global-Virtual-Reality-VR-in-Healthcare-Industry.html

- https://www.scmp.com/lifestyle/health-wellness/article/2169092/virtual-reality-helps-chinese-medicine-students-learn

- https://www.thedailystar.net/health/virtual-reality-technology-vr-provides-training-autistic-children-china-shanghai-interactive-games-1563691

- https://www.scmp.com/news/china/society/article/2156706/how-china-using-virtual-reality-help-drug-addicts-turn-their

- https://www.immersivelearning.news/2019/01/02/china-shows-its-masterplan-to-lead-virtual-reality-in-2025/

- https://health.oliverwyman.com/2020/04/covid-19-makes-digital-care-the-norm-in-china.html

- https://www.scientificamerican.com/article/in-china-mental-health-care-goes-virtual/

- https://www.iyiou.com/intelligence/reportPreview?id=83017&&did=561

- https://www.mobihealthnews.com/content/asia-pacific/oxford-vr-establishes-first-kind-vr-enabled-mental-health-solutions-asia

- https://www.prnewswire.com/news-releases/ping-an-accelerates-digital-innovations-in-response-to-covid-19-301133820.html

- https://www.scmp.com/tech/china-tech/article/2153144/china-counts-ai-find-cure-its-ailing-health-care-system

- https://www.ncbi.nlm.nih.gov/pmc/articles/PMC6493092/

- https://health.oliverwyman.com/2020/04/covid-19-makes-digital-care-the-norm-in-china.html

- https://www.affinityvr.com/top-medical-simulation-companies-using-vr-ar-in-india/

- https://journals.lww.com/cmj/fulltext/2019/10200/healthcare_simulation_in_china__current_status_ and.18.aspx

- https://seriousplaywire.com/china-medical-simulation-market-size-share-supply-demand-analysis-forecast-2025/

- https://pubmed.ncbi.nlm.nih.gov/30868484/

- https://ai-med.io/ai-med-news/aimed-vr-ar-mr-medicine-healthcare-ai/

- https://pubmed.ncbi.nlm.nih.gov/29164542/

- https://hitconsultant.net/2020/06/29/augmented-reality-and-virtual-reality-companies-to-watch/#.X43h0NDYpPY

- https://daxueconsulting.com/vr-ar-research-in-china/

- https://spie.org/news/ar-vr-mr-2020_the-future-now-arriving?SSO=1

- https://pubmed.ncbi.nlm.nih.gov/29164542/

- https://www.imedpub.com/articles/preliminary-study-of-vr-and-ar-applications-in-medical-and-healthcare-education.php?aid=21861

- https://www.chinadaily.com.cn/business/2017-11/17/content_34637487.htm

- https://academic.oup.com/pcm/article/2/4/205/5591013

- https://www.pwc.com/gx/en/news-room/press-releases/2019/seeing-is-believing-vr-ar.html

- https://www.thelancet.com/journals/lancet/article/PIIS0140-6736(20)30818-7/fulltext

- https://www.thejakartapost.com/life/2019/04/15/chinese-hospital-uses-vr-in-heart-surgery-training.html

- https://news.cgtn.com/news/2020-10-20/China-pushes-for-high-quality-development-of-VR-industry-UJFDliERAQ/index.html

- https://www2.deloitte.com/us/en/insights/industry/life-sciences/innovative-biopharma-china-digital-health-care.html

- https://www.seyfarth.com/news-insights/recent-trends-in-telemedicine-in-china.html

- https://www.globenewswire.com/news-release/2020/08/28/2085523/0/en/Insights-on-the-Augmented-Reality-Global-Market-to-2025-Key-Drivers-and-Restraints.html

- https://doi.org/10.1093/pcmedi/pbz020

- http://lawinfochina.com/display.aspx?id=65e9b5fb1fc21b64bdfb&lib=law

- https://blog.marketresearch.com/virtual-reality-and-augmented-reality-in-healthcare-a-market-overview

- https://www.pacificbridgemedical.com/publication/augmented-and-virtual-reality-make-inroads-in-asias-medtech-market/

- https://medium.com/@yonidayan/6-reasons-why-china-is-leading-virtual-reality-growth-worldwide-c9a37f4ef2ec

- https://www.nature.com/articles/d41586-018-06782-7

- https://www.nature.com/articles/d41586-019-01726-1

- https://www.nccih.nih.gov/health/traditional-chinese-medicine-what-you-need-to-know

- https://focus.cbbc.org/the-rise-of-telemedicine-in-china/

- https://www.itnonline.com/article/deployment-health-it-china%E2%80%99s-fight-against-covid-19-pandemic