Introduction

As Albert Einstein said, “in the midst of every crisis, lies great opportunity.” There is little doubt that we are in the midst of a global crisis with the COVID-19 pandemic. Not only has the world experienced an overwhelming loss of life and the effects of ill-health, we have also seen the devastating effects that the COVID-19 pandemic has had on economies, families, businesses, and relationships. Even in the midst of this tragedy, opportunities for healthcare innovations can still be found.

These uncertain times have forced healthcare systems around the world to find a way to deliver healthcare safely and remotely. This has created opportunities for innovation and the acceleration of many technologies. Virtual care, which encompasses both the delivery of healthcare services (via telemedicine and booking appointments online) and the digital assisted delivery of healthcare services (including augmented reality, virtual reality, mixed reality, Artificial Intelligence (AI), and head-mounted displays), has been at the forefront of these new healthcare changes.

COVID-19 led to an emergence of healthcare innovations in the Middle East and North Africa (MENA) region, which has had to reimagine its healthcare delivery system as the pandemic has exposed many weaknesses in its delivery model, creating opportunities for better healthcare delivery with virtual care.

The Current Healthcare Landscape in MENA

Overview

The MENA region is comprised of more than 20 countries in Southwest Asia and Northern Africa and includes some of the most affluent countries in the world as well as both low- and middle-income countries. The wealth disparity in this region creates a diverse set of needs for the citizens of each country. Those in poverty-stricken countries suffer from infectious diseases due to poor living conditions, while those in more developed nations suffer from chronic conditions.

Due to the sheer number of countries in the MENA region, it is almost impossible to view it as a homogenous entity. Its diversity, demonstrated by its many ethnic identities, cultures, and tastes, also has many different governing structures. These differences make it critical to view the region with both a macro and micro approach.

Economic Setbacks

The region suffered substantial economic setbacks as a result of the COVID-19 pandemic. A recent article by the Wilson Center, a non-partisan global policy forum, stated:

“In its latest economic outlook, the International Monetary Fund estimated that the MENA region’s recovery rate of 4% of GDP [gross domestic product] will lag behind global growth of 6% for 2021. Due to an economic contraction of 3.4% last year, the Arab States in the region, for example, lost the equivalent of 5 million full-time jobs according to the International Labor Organization. The region witnessed a sharp increase in poverty rates due to COVID-19. The World Bank estimated in January that the number of new poor at the middle-income poverty line of living on $5.50 per day increased by 13 million people in 2020 – previous estimates said this number could reach 23 million by the end of this year.”1

The pandemic also highlighted other disparities in MENA countries. Those who work in large corporations, as well as students, transitioned their activities online; however, the internet infrastructure was not ready for such a sudden shift in demand. Many governments rallied to offset internet costs for needy families, but the increase in traffic still resulted in slower internet connections.

Risk Factors Influencing Employer-sponsored Group Medical Costs

65% of the workforce in the MENA region are employed in the informal sector, leaving many without access to health insurance.5 Despite this, the MENA region is one of the greatest adopters of an employee-centric approach to health. A survey by Marsh Medical Trends found that 71% of payers in the MENA region stated they are trying to assist members to make better healthcare decisions.18

The survey found that the top three risk factors influencing employer-sponsored medical costs are:

Other risk factors affecting the MENA region include tobacco, second-hand smoke, indoor/outdoor pollution, ozone, poor water sanitation, and climate change.

Unequal Access to Care

Healthcare access in the MENA region has a two-tier structure, split between government and private services. While access to care through government services is theoretically available to all for a low fee, in reality, the quality of care provided is often suboptimal. Furthermore, access to healthcare can be difficult for those living in rural areas due to significant physical geographic barriers. Private healthcare is paid for out-of-pocket, biasing access towards wealthier nations and individuals. Patients with the resources and access to privately-funded healthcare often choose to see specialists rather than primary providers, even for minor ailments. This, along with a pattern of over-diagnosis has resulted in inflated outpatient costs and the over-utilization of healthcare provisions.18 According to a 2019 report by Mercer Marsh Benefits, the top three causes for increased healthcare costs in the MENA region are:

Chronic Disease is a Major Problem in MENA Countries

Diabetes is a significant issue in MENA countries. According to the World Health Organization (WHO), almost 5% of the world’s population, or 347,000,000, suffer from diabetes.2 A survey by the Rand Health Advisory Services found that MENA countries are among those with the highest prevalence of diabetes worldwide, including Saudi Arabia (first), Kuwait (second), Qatar (third), Bahrain (fourth), UAE (fifth), and Oman (12th).2 Mortality rates from diabetes in MENA countries increased by 216% between 1990 and 2015, and the incidence rate of diabetes is expected to increase by 110% in the next 26 years.3 In many countries, the incidence of diabetes is increasing due to an aging population. MENA countries, however, are expected to see increasing diabetes rates across all age groups, including adolescents and children.2

Many people in the region also suffer from cardiovascular disease, which was responsible for 34% of all deaths in the MENA region in 2015.3 The main culprit for these chronic diseases stems from unhealthy lifestyle choices such as poor nutrition, stress, lack of physical activity, and poor sleep habits.

Healthcare Market Size

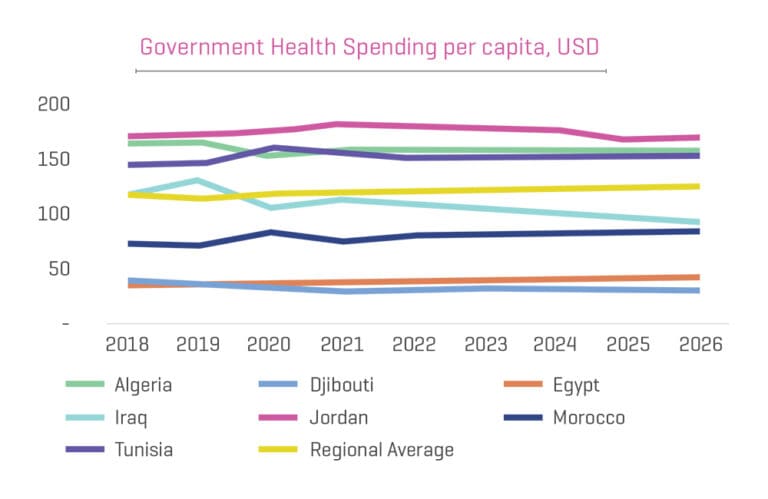

The healthcare market in the MENA region was projected to grow to $144 billion by the end of 2020; an estimate primarily driven by increased activity in the private sector which is responsible for roughly one-third of the market.19 The average MENA country spends 7% of its budget on healthcare, with almost 50% of all health spending coming from individual households at the point of care.5

The Impact of COVID-19

The COVID-19 pandemic challenged many health systems in the region, some of which are overcrowded.20 The experience was different for countries with larger economies, such as those in the Gulf, versus developing countries in North Africa or the Middle East, many of which are facing internal conflicts. The first wave of the pandemic left hospital clinicians in Lebanon, Morocco, and Tunisia exhausted.20 The public also expressed a lack of trust in the ability of leaders and officials to manage the crisis. Conversely, countries with a more stable economy responded quickly, decisively, and innovatively by using virtual doctors, sanitizing robots, and domestic mask and test production. This variation highlights the sizable differences in the region and the need for greater equity in both health financing and service delivery for those in vulnerable populations.

Despite variations in the preparedness of health systems across the MENA region, however, the overall health management strategies undertaken by MENA countries, characterized by strict containment strategies in the early stages of the pandemic, were effective at limiting the loss of life and containing the spread of the SARS-CoV-2 virus.20

Dubai Academic Health Corporation (DAHC)

A new governing body in Dubai was recently established in an effort to integrate healthcare, medical education, and scientific research via a new academic system, the Dubai Academic Health Corporation (DAHC).17 The corporation aims to improve the efficiency, quality, and accessibility of healthcare services in Dubai in accordance with the strictest standards and best practices. In addition, it will also aim to improve leadership in academic education and scientific research in the areas of medicine and health sciences.17

Market Size

The size of the virtual care market in the MENA region is estimated to grow from $3.86 billion USD in 2021 to $6.44 billion USD in 2026. With a compound annual growth rate of 10.80% over the next five years, the virtual care market is among the fastest-growing sectors.7 Recent healthcare reforms have been critical in transforming the virtual care market and have been the catalyst in expanding the reach of these types of applications.21 For example, Morocco announced ambitious reforms in July 2020 which include: consolidating previously fragmented health insurance schemes, extending financial coverage to over 11 million citizens in need, and creating a patient-centric, family medicine based model.21

Virtual care requires technical training and skill, and the shortage of these skilled technicians is a major limiting factor for market growth in MENA, along with a lack of internet connection and awareness in rural areas.

The Gap Between Interest and Usage

While the COVID-19 pandemic enabled virtual care to thrive, its long-term trajectory remains a point of debate. According to a McKinsey 2020 Virtual Health Survey, healthcare providers are still hesitant to use virtual care solutions, citing concerns related to security, profitability, and workflow integration compared to in-person services.8

In a recent interview, finance director Rafiq Shabib at the digital health platform Healthigo, a company that connects patients with doctors, insurance providers, and pharmacies, stated:

“Teleconsultation went massively up during Covid, but with ease of restrictions it went down again. Not because patients are not using it, but because healthcare providers do not have the time to do it. They still prioritize walk-in appointments, as the mindset is that walk-ins give them more money.”8

Additionally, the report found that 76% of patients are interested in virtual care while only 46% reported using it, highlighting a gap between patient interest and usage.22 Some of the factors contributing to this gap include a lack of awareness of virtual care services, inadequate education on the types of virtual care, and an insufficient understanding of insurance coverage. According to Dr. Mohamed AlGassab, operations director at Cura, a Saudi Arabia-based telehealth provider:

“Telemedicine is a relatively new concept to the local market, and initially there were some concerns over reliability and data privacy. However, the unprecedented surge in usage is helping consumers overcome their reservations, as they are actually trying the products and finding them to be safe and convenient. Necessity has also significantly boosted awareness around the technology, not just for consumers but also investors.”8

Mobile Penetration

Another factor affecting the growth of virtual care in the MENA region is mobile penetration. According to Statista, by 2025, the share of smartphones as a percentage of total connections in the MENA region was forecasted to reach around 80 percent, up from 62 percent in 2019, making it ripe for virtual care delivery.

Factors Driving and Limiting Growth

Several factors are driving the growth of virtual care in the MENA region:7

- Push to reduce healthcare spending

- Increasing use of mobile smartphones

- A growing awareness of personal healthcare management

- An increasingly aging population

- Technological advances, such as 3G and 4G

- The increase in chronic disease rates

- An increased need for cost-effective healthcare delivery

While others are limiting growth:7

- The high risk of data theft

- Lack of physician guidance to help patients use virtual care

- Resistance from traditional healthcare providers

Telemedicine Penetration

Several government systems in MENA countries have reported adoption rates between 10-15% for telehealth visits in primary care.9 In the early days of the COVID-19 pandemic, a large-sized public health system in the MENA region even saw a rapid increase of up to 30% of their total visits.9

Virtual care is still in its early years in the MENA region making exact penetration statistics difficult to assess. While it has yet to be fully adopted into the healthcare system, there are many definite opportunities to digitize healthcare in the region.

Investment in Health Technology

Another key indicator for the growth of virtual care in the MENA region is investment in healthcare technology, sometimes referred to as “healthtech.”8 A 2021 report on emerging venture markets in MENA found that year-on-year investment in healthcare startups more than tripled in 2020; however, healthcare funding only accounted for roughly 7% of that total according to founder and CEO of The Gritti Fund, Marcel Muenster:

“Sixty-nine percent [of investments] in healthcare in 2020 [in MENA] were allocated to two startups only, so while the healthcare funding has tripled from FY19 to FY20, the number of deals has decreased by 10%. I’d have expected to see a different uptake of digital health solutions by investors and its implementation. But there are simply not enough investable healthtech startups in MENA, most entrepreneurs will be opportunistic and choose an industry that is better funded, and more likely to attract an investment, and healthcare is still a highly regulated space, which could deter many entrepreneurs. There is also a lack of experienced healthcare investors that can help startups to navigate the complex ecosystem.”8

It appears that after the pandemic hit, investors began focusing their funds on existing investments while waiting for the dust to settle before committing to new deals.

Current State of Virtual Care

Main Drivers of Virtual Care

The MENA region is ripe for innovation and digitization. Many countries are placing a strong emphasis on the future with establishments such as the Dubai Future Accelerators program, which seeks to establish more collaboration between private companies, government entities, and start-up companies to create forward-thinking solutions for challenges facing the country.

In many areas of the MENA region, virtual care has the potential to reduce the burden on traditional health systems — many of which are already lagging behind those in the rest of the world in terms of capacity and capability. There are many reasons for the gaps in healthcare systems across the region, such as weak primary care infrastructure, an over-dependence on bigger secondary and tertiary hospitals, social taboos, and the rise of lifestyle diseases, according to Jalil Allabadi, founder and CEO of Altibbi, a leading digital health platform in the MENA region.

Allabadi goes on to say,

“People need quick access to primary care doctors. They need it delivered in a convenient manner and at a reasonable price. And this is what they can get from telehealth. It allows them to address their basic health concerns without needing to brave traffic, queue at clinics or visit the ER and [incur] all the unnecessary extra time and expenditure.”10

Dr. Dennis Sebastian, Regional Director at Reinsurance Group of America, points to the region’s rising aging population as well as the high incidence of hypertension and diabetes as reasons for MENA to become a growth market for these types of services. Currently, the MENA region has one of the world’s smallest shares of the global virtual care market. He adds that in the United States, virtual care is helping to solve an ever-growing percentage of health issues and has resulted in substantial cost savings.

“…but in MENA we are overcoming problems previously thought almost impossible to solve such as providing quality care to remote geographies and educating conservative communities on topics they consider taboo. A lot of value is being unlocked through telehealth, and we believe that much of the value remains untapped.”10

Cost Containment

One of the main reasons that MENA health authorities are becoming increasingly supportive of telehealth is due to its ability to reduce the spiraling costs of healthcare.10 According to Charlie Barlow, CEO of Dubai-based telehealth company Health at Hand,

“Loss ratios for payers are at all-time highs and, for the first time in nine years, we will see an increase in medical inflation amidst a backdrop of general deflation. Telehealth provides an efficient and safe cost containment solution to this problem.”10

Quantifying the Impact and Value Add

One remaining challenge to overcome is obtaining data from insurers to help quantify the exact impact and value add of virtual care. As Allabadi points out:

“This is why collaboration among telehealth providers, government entities and insurance companies is an area that is being developed currently by all parties involved in this ecosystem.”10

Regulatory Frameworks

New regulatory frameworks are needed to support the evolution of the healthcare industry in the MENA region. Officials and providers need to be empowered to take steps to help the healthcare sector become more usable, structured, and accountable. This would incentivize insurers to invest in and promote telehealth, further encouraging patient use.

Allabadi believes there are multiple inflection points to the widespread implementation of virtual care, as there are with any new technology.

“The extraordinary measures taken, for example in Saudi Arabia, contribute to real impactful adoption. The Ministry of Health in Saudi Arabia has introduced its version of a free-for-all telehealth service which has taken telehealth out of the mystery zones and into ‘normality.’ This has taken our service at Altibbi from the realm of explaining what telehealth is to explaining how our service adds value. We have seen our consultations in Saudi Arabia increase by more than three-fold since the government introduced its free service.”10

While there is a lot of momentum behind virtual care, effective regulations are critical to overcoming the challenges of implementing it in a meaningful way across the region. Christina Sochacki, a senior associate at Al Tamimi & Company, stated:

“The majority of countries in the Middle East have one or more national initiatives to adopt telehealth; however, few have adopted comprehensive telehealth policies or strategies regulating or covering its use, such as legislation that defines medical jurisdiction, liability, or reimbursements, and that promotes the protection of electronic patient data.”10

A New Perception After COVID-19

Due to its widespread use during the COVID-19 pandemic, Dr. Ziad Alobeidi, head of the telemedicine department at Medcare Hospitals and Medical Centres, says that virtual care:

“…stepped into the spotlight and helped healthcare providers and caregivers better respond to the needs of patients who have become infected with the virus and patients who needed to stay in contact with their providers.”11

According to Dr. Alobeidi, people now perceive telemedicine as a convenient, accessible, and safe alternative to access healthcare services and stay in touch with their healthcare providers.

This momentum must be seized by those in the industry to ensure that the growth of virtual care continues.

Barriers to Virtual Care

There are several barriers to virtual care in the MENA region that need to be addressed, most notably:

Organizational

The absence of a formal structure to integrate and deliver virtual care is a major barrier to development in the region. Collaboration between multiple stakeholders is required for successful programs, but a lack of established standards and policies hinders widespread adoption.

Behavioral

Many doctors are hesitant to embrace technology according to Dr. Imran Haq, a UK-based oculoplastic surgeon and founder of Sonzaikan, an AI-driven compact device with remote diagnostic software.

“There needs to be an understanding that this is [a] change. For our generation, no one is embarrassed to send a photo or a selfie. This is just the way we live. Doctors need to [realize] [healthtech solutions] are complementary, they do not threaten their own practice. The current hierarchy needs to be disbanded.”8

Economic Impact of COVID-19

The economic damage caused by the COVID-19 pandemic could also slow virtual care progress in the MENA region. Increasing rates of unemployment in a region that was already suffering from chronic unemployment will inevitably delay the spread of virtual connectivity. Additionally, the International Monetary Fund has warned of a potential looming credit crisis. An overexposure to government debt may limit the financing available to the private sector, which is needed to return to pre-pandemic levels and capitalize on the growth of digital consumption.

The Rural-Urban Divide

Digital transformation in MENA has been heavily focused on cities in the region, meaning there is a sizable rural-urban gap related to digital infrastructure and mobile internet availability and use. This further increases the inequalities between cities and rural areas, including access to high-quality education and job opportunities. The gender gap in internet access has also widened considerably over the past decade as the pandemic has disproportionately pushed more women out of the workforce than men.1

Government Oversight

Many governments view digitization through the lens of control and surveillance. This has led several countries to restrict Voice over Internet Protocol (VoIP) services (i.e., Zoom), with some only reducing restrictions due to economic necessity during the pandemic. This increase in digital authoritarianism effectively limits innovation as it slows the free flow of information, thereby vaulting politics ahead of economic development and jobs, which the region is in desperate need of.1

Data Security and Privacy

Privacy concerns are nothing new in the MENA region, but current policies were not written with the digital age in mind. Uncertainties exist around the use of health data by companies, delaying progress in the digital healthcare space. Some countries, such as Dubai and Qatar, have put in place data protection laws, but many others do not yet have defined regulations.

Current and Future Trends and Opportunities

![]() AI

AI

Across many countries in the MENA region, AI-based cognitive technologies, along with clinical decision support software and medical imaging and diagnostics, are quickly becoming popular tools for drug research and discovery. Example use cases include the elimination of unnecessary procedures thus incurring substantial cost savings, more effective hospital management and inpatient care, and improved patient data analytics and claims processing.23

![]() Diagnostics

Diagnostics

Within MENA healthcare facilities, innovators have focused a great deal of effort on remote diagnostics and patient consultations. Startups in the UAE have been the primary innovators, leveraging AI, big data, the internet of medical things (IoMT), robotics, blockchain, augmented and virtual reality solutions, and various other health management tools. Ultimately, this results in improved patient care and experiences.23

![]() Wearables

Wearables

The market for wearables in the MENA region has grown substantially over the past several years, working in conjunction with AI to track both diseases as well as vital signs. The biosensors embedded in these wearables monitor a patient’s progress continuously and at the same time create a database that can be analyzed in a multitude of ways. The analysis of which can result in significant population health insights and better patient management.23

![]() Data Analytics

Data Analytics

Another significant growth opportunity lies within the field of data analytics. A survey conducted by Protiviti, a global consulting firm, across MENA and India showed that 80% of respondents (consisting of industry leaders and C-suite executives) believe that analytics help institutions improve both their performance and accountability, while 46% believed they could improve their data governance. The same survey also found that these industry leaders believe the healthcare analytics market across the MENA region will reach a valuation of US$1.49 billion by 2024.12

![]() PwC Framework for Virtual Care

PwC Framework for Virtual Care

PwC, a professional service firm in the Middle East, has been leading efforts to support healthcare organizations in the area and is helping them to develop virtual care strategies. Their “virtual care maturity model” consists of eight key areas to provide direction for expanding virtual care offerings.13

Strategy and governance

COVID-19 increased the adoption of virtual care in the area, and now PwC is helping healthcare entities define long-term strategies, including holistic virtual care offerings and various other virtual care initiatives.

Experience and engagement

High adoption rates are vital to the continued success and growth of virtual care in the Middle East. PwC notes that replacing more traditional methods such as phone calls with virtual options is not enough if user experience suffers. Interpersonal relationships are highly valued in this cultural region, and virtual care must continue that aspect. The patient experience needs to be an integral part of designing new care offerings.

Care model design

Over the past year, the focus of virtual care has been on patient appointments, but now providers have an opportunity to expand this vision and incorporate other care pathways such as tele-ICU, remote patient monitoring, and self-care tools.

Operations workflow and integration

As we move past the height of the pandemic, healthcare facilities must now start considering the long-term clinical and non-clinical pathways for virtual care and how to best incorporate them into their workflow.

Revenue risk and progression

Sustainable reimbursement will help further facilitate the growth of virtual care in both public and private health sectors.

Technology infrastructure and interoperability

Ideally, the future infrastructure of virtual care will be seamlessly integrated with existing systems. This can be achieved by first defining interoperability requirements so that geographically isolated care facilities can take part in information exchanges to help better facilitate patients’ continuity of care and enable more personalized care.

Cognitive and analytics

Advanced data analytics can be utilized to better predict future integration needs and improvements in established systems.

Workforce and engagement

While virtual care must be patient-focused, without the support of healthcare providers and organizations, it is doomed to fail. Everyday integrations and easy workflows can help gain provider and admin buy-in, ensuring future success.

Major Virtual Care Players in MENA

Vezeeta

Vezeeta

Vezeeta, one of the highest funded healthcare startups in the MENA region, is a digital healthcare platform that helps connect patients and providers by giving patients the ability to search, compare, and book top physicians at private clinics and hospitals. The Egyptian company also has offices in Riyadh, Amman, and Dubai, and has attracted investors from all over the MENA region as well as internationally. So far, they have raised a total of $10.5 million from investors such as the Technology Development Fund, Silicon Badia, BECO Capital, Vostok New Ventures, and Endeavor Catalyst.14

Altibbi

Altibbi

Altibbi is a digital health platform that helps patients connect with general practitioners in multiple countries in under one minute via a phone call and/or chat. They are also the largest Arabic healthcare content portal, providing information on medical terminology, conditions, medications, and more.14

Altibbi is based in Jordan with operating offices in Egypt, Saudi Arabia, and the UAE. They are the largest provider in the MENA region, with more than 70,000 registered physicians. Their base of accredited physicians provides 24/7 telehealth consultations and remote care services.14 In total, they have raised $8.5 million from investors such as Middle Eastern Venture Partners, RIMCO Investments, TAMM Investments, and Endeavor.24

GE Digital

GE Digital

In 2016, the Saudi Ministry of Health partnered with GE Digital to develop a service that would enable patients to more easily reserve and cancel appointments with primary healthcare providers. Today, it is Saudi Arabia’s second most downloaded government app, and one of the most highly rated. The app has helped patients book more than 50 million appointments since its launch in 2018.15

ohumDoc

ohumDoc

This telehealth platform provides access to real-time health data exchanges to help facilitate remote patient care. By using a combination of video, audio, and externally acquired medical images, the platform helps monitor patients outside of typical clinical settings, improving access to care while decreasing costs. Today, ohumDoc is implementing its solutions in 20+ hospitals and 200+ clinics in the MENA region.15

TruDoc 24×7

TruDoc 24×7

A leading population health management provider, TruDoc 24×7 gives patients immediate access to healthcare providers over voice and video calls using next-generation telemedicine and telemonitoring technology. They provide preventative care as well as acute and chronic condition management to over 4.1 million members in the MENA region.15

Virtual Care Use Cases

Remote Patient Monitoring for COVID-19

The Sheba Medical Center in Tel Aviv, Israel employed a range of telehealth-capable and related technologies to keep clinicians and hospital staff members safe during the COVID-19 pandemic while also improving patient experiences. According to Dr. Eyal Zimlichman, the chief medical officer and chief innovation officer of the hospital:

“We have a pretty robust telemedicine platform and program at Sheba which we’ve built in the past three years under our innovation arm, called ARC, and we’ve utilized the technology and our experience in this compound, where we’re able to track our patients, take vital signs, chat with them and even examine them, without contact.”16

Tele-Cardiology Network

Saudi Arabia’s tele-cardiology platform provides access to specialists, resource sharing, and workflow efficiencies to a network of hospitals in the region. This creates a unified workflow and helps to balance workloads across the connected hospitals and ensures that patients’ records will be available when and where they are receiving care.

Heart Safe City

Royal Philips, a healthtech company, has partnered with Saudi Arabia’s Ministry of Health to work on the “Heart Safe City” project, the aim of which is to increase sudden cardiac arrest survival rates across the kingdom. The project combines educational programs to increase awareness of CPR (cardiopulmonary resuscitation), the use of publicly available automated external defibrillators (AEDs), and new technologies aimed at improving the “chain of survival” from when the incident happens to when the patient reaches the hospital.3

WinSenga

Supported by Microsoft technologies, WinSenga is a mobile tool that assists mothers with prenatal care. The handheld device scans the womb to gather data on fetal weight, position, breathing patterns, gestational age, and heart rate. The app utilizes a trumpet-shaped device and microphone to send the data to a smartphone and then recommends a course of action. The data, analysis, and recommendations are uploaded to the cloud where they can be accessed by physicians anywhere.25

Conclusion

The healthcare landscape in MENA must be viewed as a heterogeneous entity due to the sheer number of countries in the region as well as the fact that it includes some of the most affluent countries in the world as well as many low- and middle-income countries. This disparity in wealth creates a set of needs for the citizens of each country that is as diverse as the many ethnic identities, cultures, tastes, and governing structures. Many of the varying challenges faced by citizens in the low- and middle-income countries can be overcome using various aspects of virtual care though.

Market growth in the virtual care sector has already begun in the region and is estimated to grow to $6.44 billion USD by 2026. With a compound annual growth rate of 10.80% over the next five years, the virtual care market is among the fastest-growing sectors.7 This growth is driven by key trends and opportunities in virtual care such as AI, diagnostics, wearables, and the use of analytics to help institutions improve both their performance and accountability.

There are a few factors that have been key catalysts for the growth of virtual care in MENA, including high mobile penetration rates, the push to reduce healthcare spending, a growing awareness of personal healthcare management, an increasingly aging population, technological advances such as 3G and 4G, the increase in chronic disease rates, and an increased need for cost-effective healthcare delivery.

Challenges to full adoption of virtual care in the area remain and must be overcome for widespread adoption, including the gap between patient interest and usage, the high risk of data theft, a lack of physician guidance to help patients use virtual care, resistance from traditional healthcare providers, cultural barriers, and the economic impacts of COVID-19.

These developments are creating an exciting environment conducive to the rapid proliferation and growth of the virtual care industry in MENA for the foreseeable future.

References

- https://www.wilsoncenter.org/article/digital-transformation-and-covid-19-mena-turning-challenge-opportunity

- https://www.aetnainternational.com/en/about-us/press-releases/2015/02-2015-healthcare-in-the-middle-east-opportunity-to-innovate.html

- https://www.weforum.org/agenda/2019/04/how-ai-can-revolutionise-healthcare-across-the-mena-region/

- https://start.askwonder.com/insights/healthcare-mena-9iqiccy9n

- https://blogs.worldbank.org/health/covid-19-coronavirus-ensuring-continuity-health-services-middle-east-and-north-africa

- https://www.khaleejtimes.com/editorials-columns/me-on-the-brink-of-virtual-healthcare-revolution

- https://www.marketdataforecast.com/market-reports/mea-telemedicine-market

- https://www.wamda.com/2021/03/healthtech-sector-maintain-momentum

- https://health.oliverwyman.com/2021/02/born-in-the-pandemic–digital-health.html

- https://www.meinsurancereview.com/Magazine/ReadMagazineArticle?aid=42507

- https://www.almaktouminitiatives.org/en/middle-east-exchange/story/telemedicine-the-future-of-healthcare-in-mena

- https://www.itij.com/latest/news/digital-health-presents-huge-potential-apac-and-mena

- https://www.healthcareitnews.com/news/emea/virtual-care-become-new-normal-throughout-gcc-countries

- https://magnitt.com/news/top-7-funded-digital-healthcare-startups-mena-31063

- https://klasresearch.com/report/middle-east-and-north-africa-mena/1783

- https://www.hcinnovationgroup.com/covid-19/article/21130320/at-the-largest-hospital-in-the-middle-east-a-breakthrough-on-telehealth-technologyfacilitated-covid19-care

- https://www.khaleejtimes.com/news/uae-health/new-body-in-dubai-to-integrate-healthcare-medical-education-and-research

- https://www.marsh.com/content/dam/marsh/Documents/PDF/MENA/mmb-medical-trends-report-2019.pdf

- https://innovatemedtec.com/content/mena-healthcare-market-worth-144-billion-dollars-by-2020

- https://www.oecd.org/coronavirus/policy-responses/covid-19-crisis-response-in-mena-countries-4b366396/

- https://blogs.worldbank.org/arabvoices/year-after-patient-zero-essential-health-services-and-systems-mena

- https://www.mckinsey.com/industries/healthcare-systems-and-services/our-insights/telehealth-a-quarter-trillion-dollar-post-covid-19-reality

- https://www.healthcaretechoutlook.com/news/3-tech-trends-set-to-transform-healthcare-in-the-middle-east–nid-1917.html

- https://oxfordbusinessgroup.com/sites/default/files/blog/specialreports/960136/Final-Altibbi-MENA-CRR_A4.pdf

- https://news.microsoft.com/features/the-heartbeat-of-progress