The State of Virtual Care in Latin America

INTRODUCTION

The COVID-19 pandemic has forced healthcare systems around the world to accelerate their delivery of healthcare more safely and remotely by leveraging virtual care.

Consider some interesting statistics related to the recent adoption of virtual care in the US:

- Medicare primary care visits conducted virtually have increased 350-fold to 43.5% from a pre-pandemic level of just over 0.1% 27

- Nearly 90% of consumers who used virtual care were satisfied with their experience 28

- 84% of telehealth visits result in patients’ concerns being fully addressed and resolved 29

- In 2019, only 11% of US consumers used virtual care technologies BUT in 2020, at least 76% of US consumers have used (or have expressed a desire to use) virtual care technologies 30

- Due to its potential to eliminate the need for certain medications or surgeries, the digital health virtual reality (VR) market is expected to grow to $2.4 billion globally by 2026; VR technology is currently being used to treat anxiety, PTSD, and chronic pain 31

While the adoption and benefits of virtual care are exciting for patients and physicians in many countries, there are still many regions in the world where there are challenges that inhibit successful implementation of virtual care.

One of the most challenging regions is the one we will discuss in this paper which is Latin American countries (LACs).

When we say ‘Virtual Care’ we are referring to both the delivery of healthcare services (via telemedicine and booking appointments online) and the digital assisted delivery of healthcare services (including augmented reality, virtual reality, mixed reality, AI, head-mounted displays and smart glasses, etc.)

This paper will explore the current state of Virtual Care in Latin America by examining the following areas:

- The current healthcare landscape in Latin America including the overall health of the population, the number of hospitals, healthcare expenditures, the impact of COVID-19, healthcare shortages, and consumer confidence

- The market size and growth of virtual care

- The current state of virtual care including the variability in adoption between countries, factors hampering the growth of virtual care in LACs, the impact of internet connectivity, regulatory and policy issues, payment and reimbursement considerations, and having a digitally trained workforce

- Current and future trends and opportunities

- Major virtual care players

- Virtual care use cases

The Current Healthcare Landscape in Latin America

Before we dive into virtual care in Latin America, it is important to understand the current landscape in Latin America that affects the climate for virtual care.

Overall Health of the Population

While the overall health of residents in Latin American countries (LACs) has improved, there is a lot of variability as progress across the region remains unequal.

Some prime examples of this include:

- The life expectancy has increased in LACs by almost four years between 2000 and 20171

- Under age five mortality decreased by 46% and infant mortality by 35% between 2000 and 2017. Unfortunately, Grenada and Venezuela saw increases in both of those metrics1

- There has been a decrease in maternal mortality of 26% between 2000 and 2017. However, that number increased in five LACs: Saint Lucia, Dominican Republic, Haiti, Venezuela, and Jamaica1

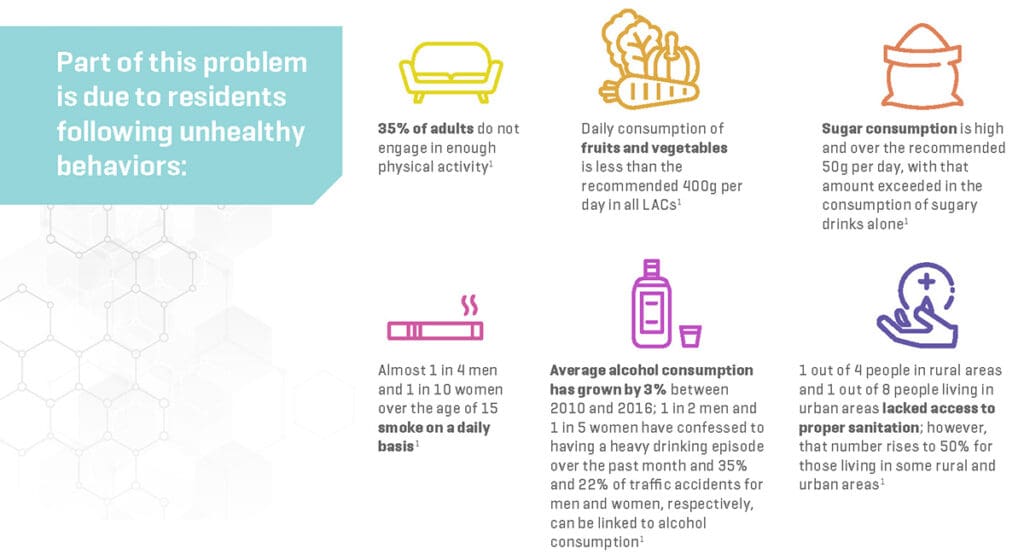

There are many critical risk factors that contribute to the poor health of citizens in LACs:

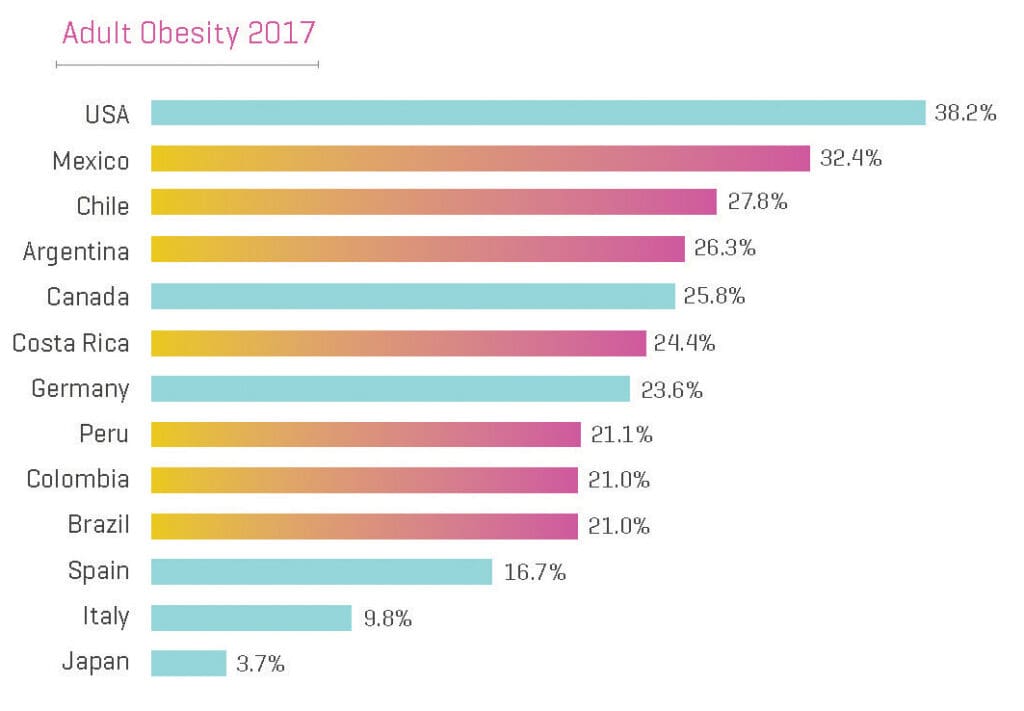

- Obesity is a huge problem in LACs as 53% of adult men and 61% of adult women are obese. Just as problematic is the fact that 28% of adolescents and almost 8% of children under the age of five are also obese.

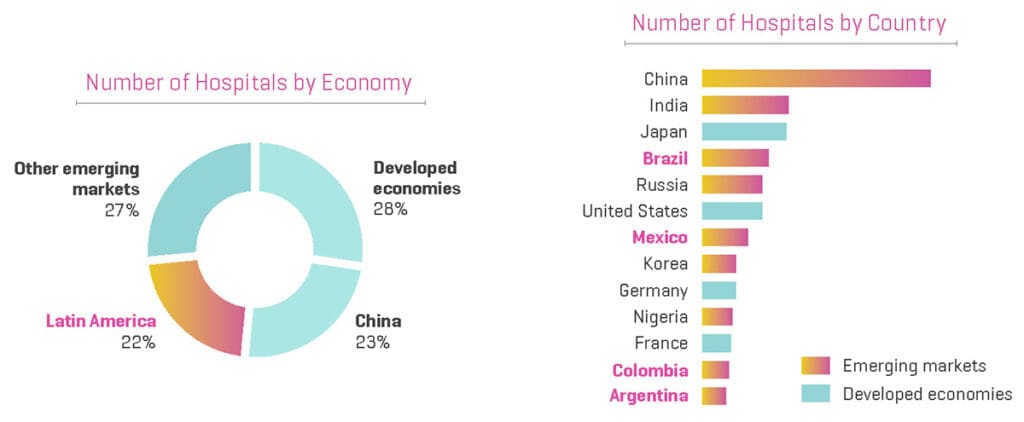

Nearly 25% of the World’s Hospitals are in Latin America

As the graphic below shows, almost 1 out of 4 hospitals in the world are located in LACs.2

It is also interesting to note that of the world’s top 10 emerging markets, four (Brazil, Mexico, Colombia, and Argentina) are in Latin America.2

While there are many hospitals in some areas of LACs, the quality of healthcare still falls short as:

- 12 of the 33 LACs are failing to meet the minimum immunization levels (90%) set forth by the World Health Organization (WHO) to prevent the spread of diphtheria, tetanus and pertussis, while 21 out of 33 fail to meet the requirement (95%) for measles2

- With respect to acute care provided in hospitals, according to data from six LACs, the case-fatality rate for patients with myocardial infarction was 54% higher than for patients in Organisation for Economic Co-operation and Development countries and 50% higher for ischemic stroke2

Healthcare Expenditure in Latin America

While health expenditures grew 3.8% per year between 2010 and 2017, spending it outpaced economic growth during the same period as GDP only increased by 3%. Even still, healthcare spending per person was only US$1,000 which is about one quarter of OECD countries (adjusting for purchasing power).2

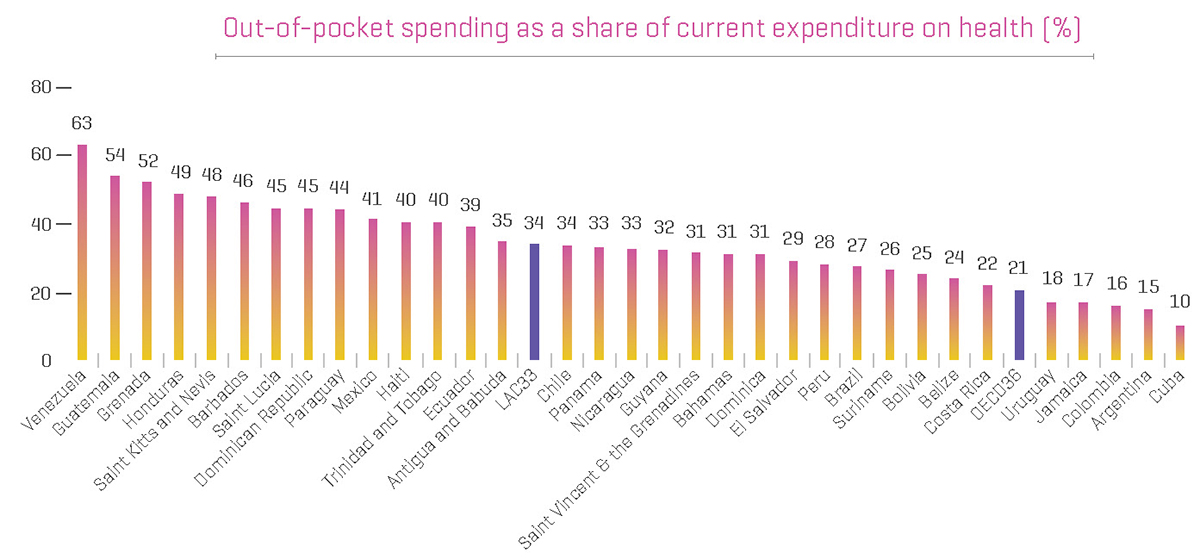

Government and compulsory health insurance were responsible for 54.3% of healthcare spending in LACs in 2017 which is significantly lower than the 73.6% in OECD in 2018. The rest are covered by private insurance and out-of-pocket expenditures by residents.2

Out-of-pocket healthcare costs are high across much of Latin America, with 34% out of pocket which is much higher than the OECD average of 21%.2

Unfortunately, almost 8% of the population in 16 LACs are spending greater than 10% of their household income on health. In addition, 1.7% of the population of 15 LACs has been forced below the poverty line as a result of out-of-pocket healthcare costs.2

How COVID-19 Has Affected Latin America

Between March and August 2020, COVID-19 spread quickly throughout Latin America with a high rate of illness and fatalities.

By November 1, 2020, Latin America and the Caribbean reported over 11.3 million confirmed cases of COVID-19 with Brazil and Mexico accounting for over six million cases between those two countries alone. Brazil and Mexico currently rank second and fourth in the world, respectively, in terms of COVID-19 deaths. Similar to the rest of the world, many efforts have been made to reduce the spread of the disease including the widespread implementation of quarantine and stay-at-home measures.3

There are several challenges that remain across the region:

- The pandemic is being felt even more in LACs due to the precarious sanitation and structural inequalities they already face. LACs are already dealing with other epidemics, namely measles, dengue fever, and other arboviruses.

- LACs are feeling the pain of COVID-19 economically as well as the disruption of supply chains, the reaction of the markets and other factors destabilizing economic growth which are severely hampering the ability of LAC governments to respond to the pandemic with fiscal measures.

- The first two points speak to the “supply side” or the delivery of healthcare services. However, LACs are also faced with a challenging and complicated environment on the “demand side” as the healthcare infrastructure across the region is already severely overloaded.

On the bright side, hopefully this pandemic helps open a window of opportunity for LACs to establish priorities to battle pandemics in terms of innovating new measures to combat them. It is also likely that the topic of healthcare reform will garner more attention.

In a great number of LACs, healthcare is a social right. In reality, however, the poorest sectors of the population are unable to access and use these services due to rationing or prohibitive cost. The COVID-19 pandemic is exposing how perilous this situation really is for the entire population.

Healthcare Shortages: LACs vs OECD

Another reason that people are unable to receive adequate healthcare in LACs is due to the bottlenecks of human and physical resources.

Consider that:

- The average number of physicians per 1,000 people in LACs is only two and most countries are less than the OECD average of 3.52

- The average number of nurses per 1,000 people in LACs is less than three, which is significantly lower than the OECD average of nine2

- The availability of medical technologies is much lower than the OECD: For example, five times less MRI units, less than half of the mammography units and more than five times less radiotherapy units2

- Hospital beds per 1,000 people on average is 2.1 and only three countries (Argentina, Barbados and Cuba) are higher than the OECD average of 4.7.2

- Mental health resources are particularly scarce as the number of psychiatrists is almost five times lower than in OECD, while the number of nurses and beds for mental health patients is roughly three times lower2

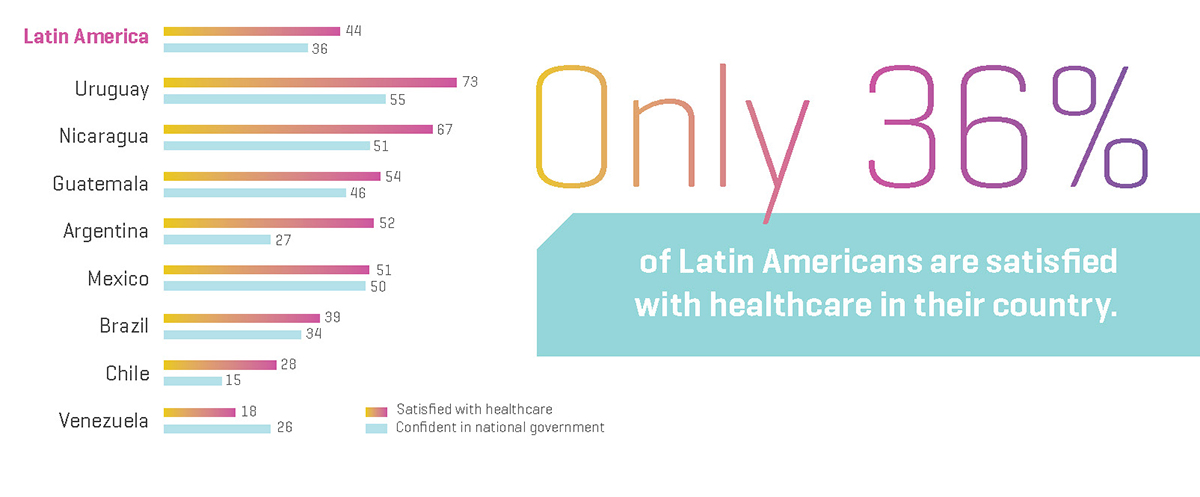

Consumer Confidence in Healthcare

Yet another challenge for LACs to overcome is the issue of low consumer confidence in both government and healthcare.

The graphic to the left shows the percentage of people in LACs who are satisfied with healthcare and their government. As you can see, only 44% of people are satisfied with their government and even less, 36%, are satisfied with the healthcare in their country.4

Market Size and Growth of Virtual Care in Latin America

Now that we have a good baseline understanding of the current healthcare landscape in Latin America, let’s take a deeper dive into virtual care in terms of the size and growth of the market.

Size of the Virtual Care Market in Latin America

The LAC virtual care market was valued at US$1.4 billion in 2019 and is projected to hit a valuation of US$5.5 billion by 2026 with a growth rate of more than 20% between 2020 and 2026.5

As with other parts of the world, the COVID-19 pandemic including social distancing, lockdowns and quarantines implemented by governments across the region has been a major catalyst for the growth of virtual care.

In addition, rising numbers of chronic conditions such as cancer, heart disease and diabetes are accelerating this market growth. One factor that is likely to dampen market growth is privacy and data security concerns related to virtual care.

Tele-monitoring services accounted for 25% of virtual care market share for LACs in 2019 and this sector is expected to grow significantly as it has a wide range of applications for treating chronic diseases such as asthma, diabetes and cardiovascular diseases. In addition, the fact that LAC governments have ramped up the remote monitoring of patients has also boosted overall growth.5

By 2026, the tele-home segment is expected to reach US$1.7 billion, its growth spurred by home treatments of non-emergent care due to travel restrictions and lockdowns brought on by the COVID-19 pandemic.5

In terms of medical specialties, the mental health virtual care segment was valued at US$283.1 million in 2019 and is expected to grow significantly in the coming years due to both the prevalence of mental health disorders as well as the limited number of mental health providers noted above.5

By region, the virtual care market in Mexico is expected to lead the way, registering a CAGR of 21% through 2026. This is due to the COVID-19 pandemic, increased knowledge by citizens of the benefits of virtual care, favorable government support, and the increased adoption of technologically advanced digital health devices.5

Current State of Virtual Care in Latin America

There are numerous factors that provide context to the current state of virtual care in Latin America that we will explore in this section.

Huge Variability in Adoption Between Countries

The adoption of virtual care across Latin America varies dramatically from country to country. A recent study conducted by Global Health Intelligence and Florida International University reported that 65% of hospitals in Chile leveraged virtual care, while only 25% of hospitals in Colombia had utilized the service.8

While those two countries are the two extremes of the study, virtual care adoption rates vary greatly across Central and South America.

Countries such as Argentina, Costa Rica, Peru, and Mexico each had an adoption rate of less than 30%, while Uruguay and Guatemala both saw adoption rates in the mid 40%, while 35% of hospitals in Panama were using virtual care.8

The authors of the study pointed to several factors for this large variation including organizational characteristics of the health system, the national environment for virtual care, legal frameworks, regulatory policies, and healthcare spending.

An interesting item of note from the study was that five of the countries involved in the study had an explicit national virtual care policy and strategy and yet four of the five had an adoption rate of less than 30%.8

According to the authors of the study:

“Our study confirms that telemedicine adoption is widespread in Latin America but has not yet achieved its full potential in terms of broad program scale. Efforts to implement telemedicine are isolated and scattered, often left to the public sector or taking the form of insulated projects that are not sustained…While this approach creates pockets of rapid progress, progress is often dispersed, resulting in meager industry-wide gains in efficiency.” 8

It is worth noting that the study included only those hospitals who reported whether or not they used virtual care – which accounted for roughly 65% of hospitals in each country.

This difference in the level of adoption of virtual care in Latin American countries is confirmed by Morel Orta, President of the Ibero-American Association of Telehealth and Telemedicine (AITT). He considers that there are several causes for this inequality.

Factors Hampering the Growth of Virtual Care in LACs

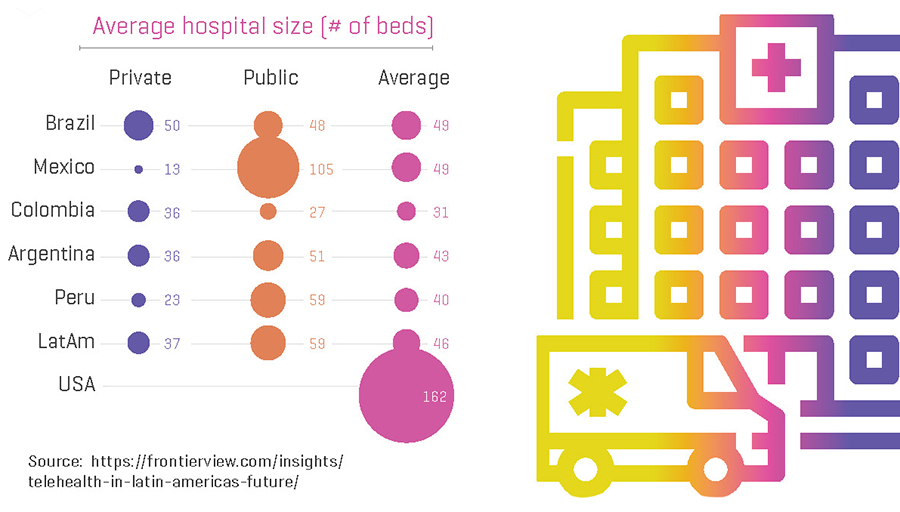

Earlier in this paper, we highlighted that one in four hospitals in the world are based in LACs.

However, while there are numerous hospitals, there are a couple of factors related to the hospitals themselves that will limit the pace of adoption and capabilities related to virtual care.

- Hospitals in LACs on average are 3.5 times smaller than hospitals in the US.9

- There exists a significant size and infrastructure gap between public and private hospitals in LACs.

This has several implications for the rollout of virtual care solutions in LACs:

- The hospital market in LACs is much more fragmented with a large number of smaller players

- There are fewer hospitals with the ability to create centers of excellence due to limited size and throughput

- Hospitals do not have the ability to leverage their size and scale as those in OECD regions do to procure technology equipment and to expand their capacity

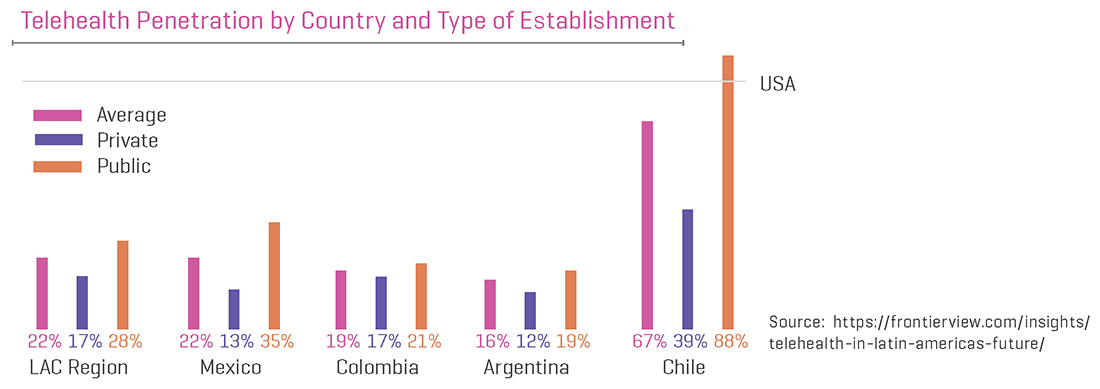

Another factor limiting the growth of virtual care in LACs is the sizeable difference in penetration between public and private institutions.

As the graph below shows, virtual care penetration is 30% higher in public institutions than it is in private institutions.

The reason for this is due to the fact that the lack of a regulatory framework is effectively limiting the expansion of virtual care into the private sector. This means it will be critical to engage both public and private hospitals with suitable incentives.

Another potential growth factor revolves around the fact that LACs are failing to target the primary care health needs of their populations. Telemedicine penetration in primary care is only 15%, while less than one in four general hospitals utilize virtual care.

Whilst the COVID-19 pandemic has increased technological innovation and helped propel policy changes related to virtual care in LACs, other elements need to be addressed for virtual care to gain traction and scale. Some of those include sufficient technological connectivity and infrastructure, legislative policy frameworks, reimbursement policies, proper security, a workforce who is trained and technologically savvy, and the protection of personal health information (PHI).

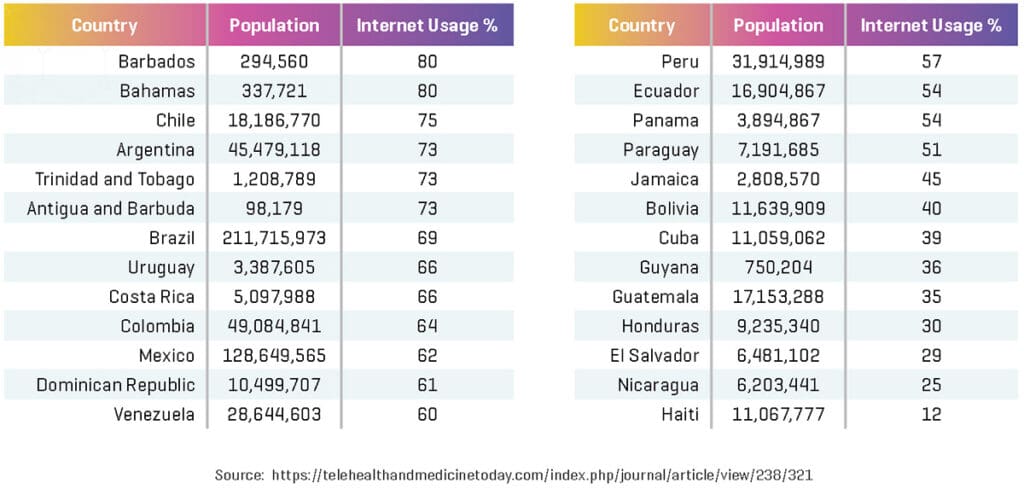

The Impact of Internet Connectivity

For virtual care to expand there is a requisite need for reliable digital connectivity.

As can be seen in the table below which outlines internet usage as a percentage of the population by LAC, only 60.8% of citizens in LACs actively use the internet.10

Even though internet usage is somewhat high, it is problematic for virtual care that long-term evolution (LTE) capabilities for wireless communications for mobile devices are not consistent throughout the region. This greatly affects the scalability of virtual care. In 2015, LTE was available on only 8.9% of lines, with countries such as Uruguay reporting 48.9% and countries such as Nicaragua reporting only 0.11%.

This lack of access in many countries is crippling for virtual care. The Pan American Health Organization (PAHO) has recommended that any virtual interaction between a clinician and a patient should be conducted over internet connections that are stable and fast including asymmetric digital subscriber line, fiber optic, cable, or 4G, with a minimum of 1 MB/300 kb.

Regulatory and Policy Issues

One of the factors that has an ability to significantly accelerate or impede the growth of virtual care services is legislation and regulation.

To realize the enormous potential of virtual care will require full political commitment via the sustainable, applicable and integrated execution of initiatives related to virtual care, including standards, digital literacy, electronic medical records (EMRs) and training, and the use of digital devices for health.

Some recent positive steps in this direction include:

- The Congress of Colombia enacting Law 2015 on January 31, 2000, which produced an interoperable EMR system which grants clinicians online access to relevant clinical data. This law requires the implementation of this system by the entire country by 2025.

- The Brazilian Ministry of Health, in response to the COVID-19 pandemic on March 23, 2020, temporarily allowed telemedicine via Ordinance 467. This ordinance allows for the possibility of virtual care in both public and private institutions through the pandemic.

- On March 20, 2020, Puerto Rican Governor Wanda Vázquez Garced signed Joint Resolution 491 which made the territory’s virtual care laws more amenable by reducing the requirements for clinicians to conduct virtual care visits during the pandemic.

- On an international level, there have been calls for legislation that would enable virtual care services between nations to fight the pandemic. In addition, the global health community is also turning to digital technologies, data, and cross-border e-health interactions to come together in a unified way to show evidence and experience related to the detection, prevention, recovery and response to COVID-19.

- In December 2020, representatives from the Health Commissions of the Parliaments of the Americas and PAHO agree to proceed on implementing laws to accelerate the digital transformation of healthcare in the post-pandemic era.

According to Mario Fiad, President of the Health Commission of the Senate of Argentina:

“Health and rights are an important area of intersection that needs to be strengthened… The era of digital health has no frontiers. Technology provides us with tools to further this important development through solid regulatory frameworks that we should and must implement.” 11

Convened for the first time virtually due to the COVID-19 pandemic, the event brought together members of congress from the following countries: Argentina, Bolivia, Brazil, Cuba, Chile, Ecuador, El Salvador, Guatemala, Honduras, Mexico, Nicaragua, Panama, Paraguay, Peru, Dominican Republic and Uruguay.

At the conclusion of the event, a call to the heads of state and governments of LACs to adopt concrete measures titled the Declaration of Argentina was presented which includes the following steps:

- Implement public policies and regulatory instruments that enable inclusive digital health with emphasis on the most vulnerable.

Ensure universal connectivity in the health sector by 2030.

Implement health information systems that are comprehensive, interoperable, reliable, and cybersecure, and that are based on ethical and legal standards for data management.

Mainstream human rights in all areas of the digital transformation of the health sector.

Implement an architecture of public health in accordance with the era of digital interdependence and global health.

Promote spaces for the exchange of successful experiences and cooperation in the field of digital health, with the aim of promoting digital health transformation with strong legislative and regulatory support.11

Other examples of virtual care legislation and policies in LACs include:

- In Mexico, the first virtual care action plan dates back to 2007, with one of its objectives being: “to support the incorporation in medical care regulation of the use of teleconsultation and remote monitoring.”12

- In Colombia, their virtual care legislation was enacted back in 2010, allowing tele-consultations, which were not utilized often. Due to the pandemic, the federal government issued a policy in April 2020 which would, among other things, standardize and accelerate virtual health.

- One of the success stories of virtual care in LACs is Chile, which has implemented virtual care initiatives since at least 2005, including tele-consultations. While the country does not have specific e-health legislation, its national telehealth program has been in place since 2018 and is supported by their constitution.

- Peru passed a specific legislation in 2016 as their health ministry (Minsa) is responsible for policy as well as for creating a virtual care commission to identify and promote improvements.

- As mentioned earlier, former Puerto Rican governor Wanda Garced recently signed a resolution which makes their virtual care laws more flexible and reduces requirements for clinicians practicing virtual care during the pandemic, which also includes those professionals who may not ordinarily be able to utilize virtual care.

According to the Ibero-American Association of Telehealth and Telemedicine (AITT), there is still much work to be done for the Latin American region to have quality regulations on virtual care. Of its 19 Latin American member countries, only eight have at least one draft law.

Payment and Reimbursement Considerations

Beginning in March 2020, the Centers for Medicare and Medicaid Services in the US passed emergency legislation which permitted telehealth payments and reimbursements for those providing the services. This waiver meant that Medicare would begin paying for office, hospital or other appointments conducted via telehealth. Prior to this legislation, Medicare would only pay for telehealth on a restricted basis.

In LACs, healthcare payers and insurance companies have been forced to deal with ambiguous and inconsistent virtual care polices and legal frameworks over the years.

As of November 1, 2020, there were five countries who had clearly defined medical jurisdiction, liability, or reimbursement of telehealth services – Chile, Colombia, Costa Rica, Peru, and Uruguay.11 Many other countries, including Argentina, Guatemala, Mexico, and Panama do not.11

To accelerate its usage and take advantage of its benefits, financial models for clinicians and insurance companies need to be further refined. One of the main challenges to the acceleration of virtual care has been the financial stability of such models and incentives, as reimbursement has been more focused on the care processes that take place within healthcare facilities in-person instead of care processes which affect patient outcomes.

Having a Digitally Trained Workforce

Another key to the expansion of virtual care in LACs is a well-trained and technologically savvy workforce.

Up until 2017, there were approximately 2.28 physicians per 1,000 inhabitants in LACs and the Caribbean, which is barely enough for their citizens, while countries such as Haiti, Guyana, Honduras, and Guatemala had less than one physician per 1,000 inhabitants.

Beside the shortage of clinicians, virtual care training and research programs in LACs are rare and poorly documented. Most countries fail to offer specific programs aimed at educating workers in the area of digital medicine. Those who want to become educated oftentimes are obliged to look for their education in other countries, which can be challenging as most LACs rank low in the English Proficiency Index.

According to Francesc Saigí Rubio, Director of the WHO Collaborating Center on e-Health, offering these programs is key.

“Universities have an important role to play here. It would be appropriate to incorporate this training in undergraduate courses when the physician is in his or her initial training. There is no need to talk about postgraduate studies; it should already be part of the undergraduate program. The telemedicine of the present is the medicine of the future. We should not talk about telemedicine as an exception, but as something normal. For this to be the case, this training must be incorporated into the physician’s initial education,” he commented.

By offering sufficient digital health training, LACs will improve their health systems overall while ensuring appropriate service delivery. Those training programs should be created to meet the needs of the specific area by taking into consideration social, cultural and institutional factors. Programs may also wish to include exposure to and create collaborations with those digital health centers around the world which have already been established. These collaborations could result in expanded research studies, internships, and shared best practices.

Current and Future Trends and Opportunities

There are a myriad of current and future trends and opportunities related to virtual care in LACs that will be discussed in this section.

Fear of Being Exposed to COVID Has Increased Usage

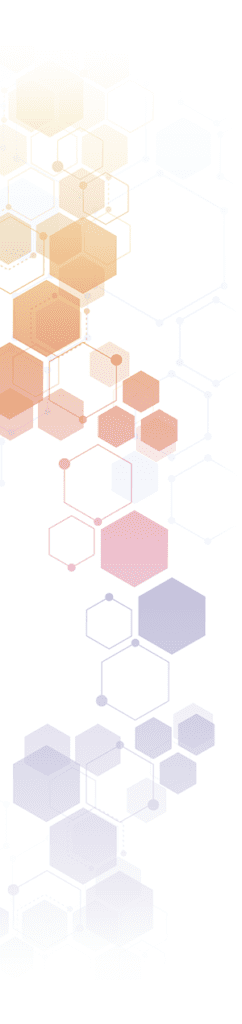

Much of the growth in virtual care over the past year has been driven by patient fear of contracting COVID-19 by going to the doctor’s office. These patients (particularly those in Mexico and Brazil) have turned to virtual care to reduce their risk of exposure as can be seen in the graphic below.

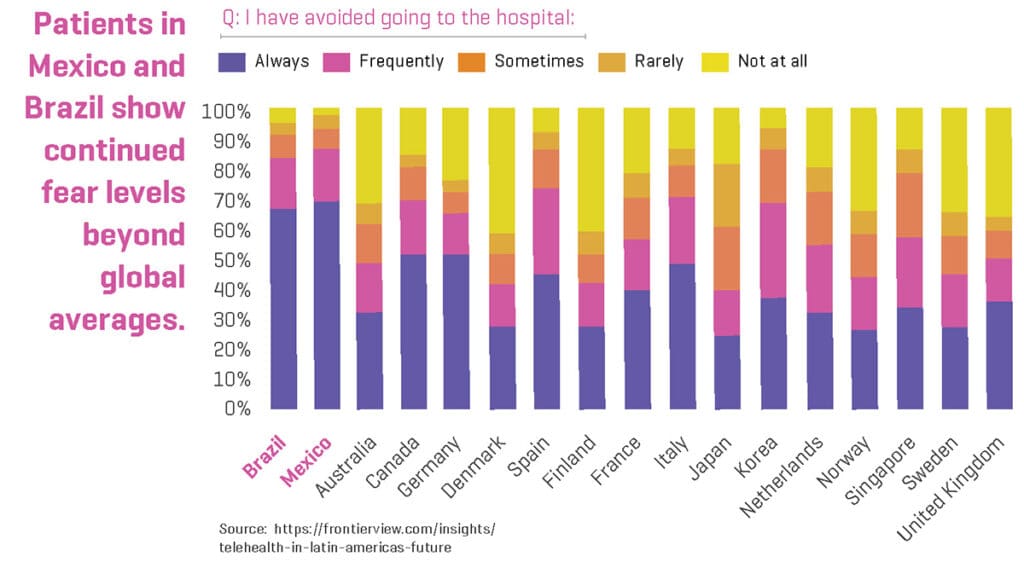

This fear caused many large-scale organizations to leverage virtual care to address basic consults and mental health as can be seen in the graphic below.

The Impact of Financing on Virtual Care Adoption

Many of the opportunities that arise in virtual care will be driven by healthcare financing and in particular public sector budgets.

The Negative Financial Impact of COVID-19 on Virtual Care

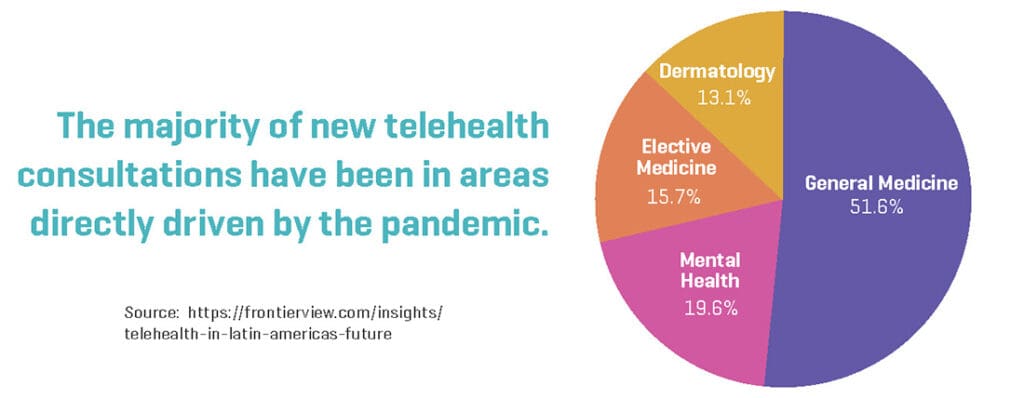

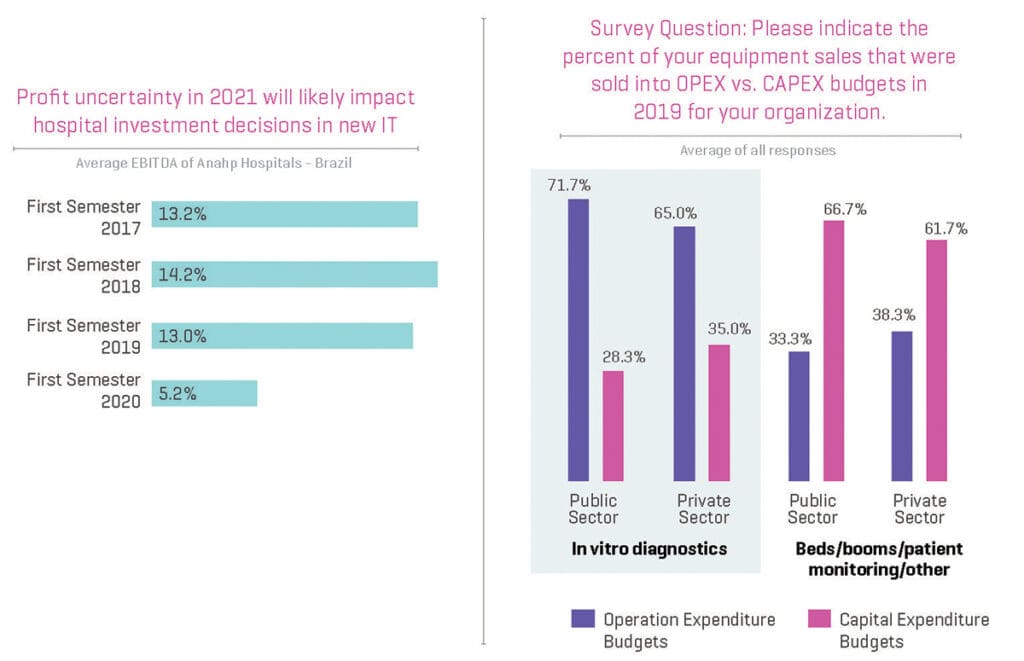

The COVID-19 pandemic looks as if it may significantly affect current government spending on virtual care due to reduced revenue from other sources in 2020. In order to finance current spending, many LAC governments are decreasing their investment and IT budgets as can be seen in the graphic to the right.

Similarly, reduced hospital margins will affect their ability to invest in virtual care as well.

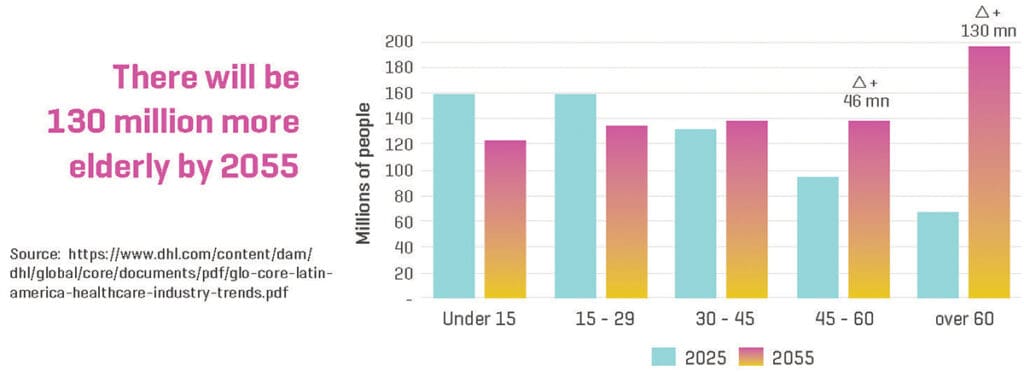

The Fastest Aging Region in the World

Another major trend affecting LACs is the fact that the region is the fastest aging region in the world.

By 2020, over 21% of Latin Americans were over 60, which is up dramatically from 2010 when it was just 10%. The aging population is also the greatest burden to healthcare budgets as over 80% of those over 60 have at least one chronic disease. Home health solutions achieved a CAGR of 8.7% between 2015 and 2020 – meaning there could be a significant opportunity for virtual home health care to capture some of that market share.14

Latin America is Also Leading the Global Obesity Epidemic

LACs have a huge problem with obesity which leads to many other diseases including heart disease, high blood pressure, diabetes and stroke among others. In fact, 30% of LAC residents have high blood pressure while 10% of them have diabetes. The number of cases of cancer which currently stands at 1.1 million in LACs is expected to double by 2030. Experts are predicting that obesity will be a major problem in LACs for at least the next 30 years.

Patients Embrace Mobile Apps

People want to take more of a proactive role in their health management and are leveraging mobile apps and virtual care to do so.

In Guatemala, there are two examples that demonstrate this trend of adopting mobile apps for online medical consultations and monitoring.

One is DoctorsCo, created by entrepreneur Javier Santa Cruz. He considers that these apps make it easier for people living in remote areas to access health services. “Technology such as telemedicine helps people living in remote areas who have access to the internet. I once visited a village near the city of Tecpán, where there was no electricity or water. But I was curious that people did have access to the internet, with Facebook and WiFi on their phones. That is what mobile telephony allows: to reach remote places. In those places, it may be difficult to get to a medical center, but through telemedicine you can receive attention in your recovery process. Mobile telephony and apps help that process. People would have a lot of access to many opportunities. And, in the case of DoctorsCo, it allows you to avoid the loss of information. When you save something in the Cloud, it is backed up in many places. The doctor, no matter where he or she is, has access to all their patient records. It is not necessary to go to the clinic for a physical record. From your phone or computer, you can download all the information, review it, and even update it,” he commented.

Another app is Doctor Online, created by Marcel Roehrs, an entrepreneur that believes that it will take some time before people begin to trust virtual care and adopt telemedicine in Latin America.

“The more people know about it, the more they try it and it becomes the standard. But that takes time. I wish it would be a matter of months, but it takes time for these behavioral changes to really go mainstream. The trend has only just started, and so there is still a long way for it to become mainstream,” he said.

Major Virtual Care Players in Latin America

Some of the major players in the virtual care industry in Latin America are:

1. 1Doc3

1Doc3 was established in June 2014 by Javier Cardona and is Latin America’s largest telemedicine provider. The company’s all-in-one telemedicine platform is focused on the issue of access to care in LACs as the region is plagued by a shortage of clinicians as patients wait at least a week just to see a doctor. 1Doc3 is leveraging telemedicine to reduce costs and time for patients.

The platform begins with an AI-driven symptom checker and then triages the patient to chat securely with a doctor.

Since the start of the COVID-19 pandemic, the service has exploded with a seven-fold increase in consultations. The platform saw 300,000 patients in LACs in May of 2020 alone.

Cardona and his team are motivated to “solve problems for 1Doc3’s patients and users” with his long-term vision for 1Doc3 “to become the healthcare gateway in the [Latin American] region.”18

2. Pager

Seguros SURA Colombia is the largest subsidiary of Suramericana SA, which is one of the biggest insurance companies in Latin America, currently operating in nine countries. The Colombian insurance market leader, Seguros SURA Colombia is collaborating with New York City-based digital health company Pager to provide its customers with a personalized connected care experience as they go through their healthcare journey.

As the company continues to grow its customer base in LACs, it teamed up with Pager to give its customers a first-of-its-kind healthcare solution.

According to Juan David Escobar, CEO of Seguros SURA Colombia, “Seguros SURA Colombia sees synergies with Pager in terms of enhancing remote access and democratizing access to quality healthcare.”19

3. Physitrack

A provider of multi-lingual virtual care technology in over 100 countries and the main provider of remote patient engagement platforms for physical therapy and orthopedic clinicians during the COVID-19 pandemic has expanded into Latin America.

4. Tula Salud

An NGO that operates in northern Guatemala and is financed by a Canadian power plant. It is dedicated to reducing maternal and infant morbidity and mortality and malnutrition. It uses digital programs aimed at the neediest rural population of Guatemala. It also trains doctors and nurses through distance learning.

For Executive Director Isabel Lobos, virtual care is a great opportunity to improve healthcare in the region. “It is a great opportunity for countries like Guatemala and the rest of Latin America in a number of ways. First, to make health services more accessible to the population. There are still great challenges regarding access to different types of services. Being able to count on the support of technologies to reach a population that is generally excluded or neglected is an excellent opportunity,” she said.

5. Other Major Players

There are a multitude of major global organizations who are focused on offering their virtual care hardware, network, and software products and services, including: McKesson Corp., AMD Global Telemedicine, Philips Healthcare, Medtronic Inc., CISCO Systems, Inc., Honeywell Lifesciences, GE Healthcare, Cerner Corporation, and Aerotel Medical Systems – to name just a few.

Virtual Care Use Cases

In this section, we will explore some of the more interesting virtual care use cases that we have seen emerge in Latin America.

1. MedRoom Means Less Cadavers to Prod

MedRoom is a Sao Paulo-based VR company who has developed a 3D model of the human body. This gives students a more interactive experience while learning anatomy. The technology gives users the ability to isolate structures, organs and systems to get a better understanding of the human body.

Lately, according to the CEO and Co-founder of MedRoom, Vinicius Gusmão, the company has expanded outside of health education to meet the healthcare market’s more varying demands:

“For example, a company that produces stethoscopes can display a 3D version of its product within simulations and clinical cases developed with our virtual reality for training doctors and nurses.” 15

2. MEDIX Lab Brings VR to Healthcare in El Salvador

Medix Lab is a joint partnership between the BID Lab and the Healthcare Professionals Institute of El Salvador which aims to use VR software to train 3,000 healthcare professionals.

Vertex Studio has been tasked with creating the virtual lab which will enable medical personnel to handle real-life simulations. A working prototype is being developed while the final product is due in June 2021.

3. Smart Doctor

In Peru, startup Smart Doctor recently entered into a joint partnership with the government’s Ministry of Health to offer virtual triage, consulting and monitoring of those infected with COVID-19.

4. Kawok

Created by the NGO Tula Salud, Kawok is a computer system used to monitor patients in the north of Guatemala. It offers data capture through mobile devices, in which health workers follow up with their patients, with information synchronized in real time with public health institutions.

5. Doc-Doc

Doc-Doc, another Colombian virtual care company is trying to improve the well-being of physicians while emergency rooms in the country are operating at four times capacity. For a monthly $6 subscription, patients get unlimited access to chat with 18 types of specialists via smartphone. The founder of Doc-Doc modeled the user experience from WhatsApp as the app is extremely popular in LACs.

6. Government of El Salvador

In response to strict lockdown measures to control the COVID-19 pandemic, the Government of El Salvador built a virtual care service in August. Its first phase saw it serve three prioritized groups: pregnant and post-partum women, children under five years old, and those patients needing mental health care.

By dialing 131, people are able to get in touch with health practitioners which include gynecologists, primary care providers, family doctors and others.

According to Gabriela de Bukele, the First Lady of El Salvador who has been working hard to promote the program:

“Dialing 131 will provide support for issues related to your pregnancy, your baby or your young children, and thus will improve the health of your family from home.”

Conclusion

In this paper, we discussed some of the key challenges as well as some of the factors that will enable virtual care to flourish and thrive in LACs.

Although the overall health of residents in LACs has improved over the last decade, there is a lot of variability as progress across the region remains unequal and some countries are doing better than others. Many health issues can be attributed to a high obesity rate as well as residents following unhealthy behaviors.

While nearly 25% of the world’s hospitals are based in LACs, the quality of healthcare still falls short as over one third of LACs fail to meet minimum immunization levels and acute care metrics for many diseases are subpar.

When it comes to virtual health, the LAC virtual care market was valued at US$1.4 billion in 2019 and is projected to hit a valuation of US$5.5 billion by 2026 with a growth rate of more than 20% between 2020 and 2026.

Despite this growth, there are many healthcare challenges faced by LACs including:

- Huge variability in virtual care adoption between countries

- The lack of internet connectivity in many countries is crippling for virtual care

- While there has been some positive movement in regulatory and policy issues, there is still much work to be done for the Latin American region to have quality regulations on virtual care – of its 19 Latin American member countries, only eight have at least one draft law

- In LACs, healthcare payers and insurance companies have been forced to deal with ambiguous and inconsistent virtual care polices and legal frameworks over the years

- Virtual care training and research programs in LACs are rare and poorly documented

Many, if not all, of the challenges above can be met by investing in sufficient technological connectivity and infrastructure, developing legislative policy frameworks and reimbursement policies, implementing proper data security, and developing a workforce who is trained and technologically savvy.

Once these challenges are overcome, there are numerous benefits that LACs can leverage by accelerating the use of virtual care across the region such as:

- Boosting access to those who live in remote locations

- Expanding access to specialty care and physicians that patients would not typically be able to see

- An ability to optimize both physician and patient schedules

- Reducing travel as patients and in some cases, physicians would not need to leave their homes.

- Increasing the amount of health equity for all

- Increasing access for preliminary diagnosis and enabling physicians to “triage” patients to the right specialist sooner

- Reducing costs with respect to time savings and average cost per visit (average virtual care consult = $79, average doctor’s visit = $149, average ER visit = $1,734)9

The benefits of virtual care for healthcare professionals and patients in LACs are numerous. And with the unprecedented challenges that COVID-19 has presented, the need for countries to adopt these practices quickly has never been more critical.

To paraphrase author William Gibson, “the future of medicine is already here, it’s just unevenly distributed.” Despite some promising case studies on the use of telehealth platforms for delivering care especially in rural areas, we have identified a number of barriers which need to be surmounted for virtual care to truly scale across the region and realize the benefits of improving access while reducing the cost of care. Inadequacies in connectivity and bandwidth, lack of progress in upskilling the workforce in new digital technologies, and political commitment, legislation, and regulation have yet to catch up with demand for virtual care. If these challenges can be addressed, then Latin America can embrace the next wave of digital transformation with confidence.

References

- https://www.weforum.org/agenda/2020/07/covid-19-sustainable-health-systems-latin-america/

- https://frontierview.com/insights/telehealth-in-latin-americas-future/

- https://telehealthandmedicinetoday.com/index.php/journal/article/view/238/321

- https://www.oecd-ilibrary.org/social-issues-migration-health/health-at-a-glance-latin-america-and-the-caribbean-2020_6089164f-en

- https://www.fractovia.org/news/latin-america-telemedicine-market/13505

- https://www.marketwatch.com/press-release/latin-america-telemedicine-market-size-historical-growth-analysis-opportunities-and-forecast-to-2026-2020-11-17?tesla=y

- https://blog.equinix.com/blog/2020/07/06/telemedicine-is-ready-to-take-off-thanks-to-digital-infrastructure/#_edn3

- https://www.mobihealthnews.com/content/telemedicine-adoption-inconsistent-across-latin-american-countries

- https://telehealthandmedicinetoday.com/index.php/journal/article/view/238/321

- https://www.paho.org/en/news/30-12-2020-latin-american-parliamentarians-and-paho-seek-advance-laws-accelerate-digital

- https://www.bnamericas.com/en/features/is-covid-19-the-push-e-health-needed

- https://www.jmir.org/2019/12/e16513/#Introduction

- https://www.dhl.com/content/dam/dhl/global/core/documents/pdf/glo-core-latin-america-healthcare-industry-trends.pdf

- https://contxto.com/en/brazil/latin-america-virtual-reality-healthcare/

- https://www.fimeshow.com/content/dam/Informa/fimeshow/en/downloads/FIME19_Healthcare_Innovation_NorthLatAm.pdf

- https://reliefweb.int/report/el-salvador/el-salvador-begins-telemedicine-pregnant-women-new-mothers-and-other-priority

- https://healthtransformer.co/with-300k-consults-a-month-1doc3-has-become-the-largest-telemedicine-provider-in-latin-america-c8ec35e6ba60

- https://hitconsultant.net/2020/02/27/pager-international-virtual-care-model-latin-america/#.YCvqg2hKjIU

- https://www.youtube.com/watch?v=hMITi4UZgvE

- https://www.teleiberoamerica.com/legislaciones/

- https://www.youtube.com/watch?v=d4ie5lXqecg

- https://www.youtube.com/watch?v=UKXRJkBRmnQ

- http://www.tulasalud.org/

- https://www.youtube.com/watch?v=6jmiwuX7C1Q

- http://www.tulasalud.org/Programas/tele-medicina/kawok

- https://aspe.hhs.gov/pdf-report/medicare-beneficiary-use-telehealth

- https://www.healthcareitnews.com/blog/beyond-telehealth-virtual-care-technology-trends-will-transform-healthcare

- http://go.americanwell.com/rs/335-QLG-882/images/American_Well_Telehealth_Index_2017_Consumer_Survey.pdf

- https://www.mobihealthnews.com/news/mckinsey-250b-us-health-spending-could-become-virtual

- https://www.researchandmarkets.com/reports/5118766/vr-in-healthcare-market-by-product-technology?utm_source=dynamic&utm_medium=CI&utm_code=7fg7dm&utm_campaign=1408575+-+Insights+into+the+VR+in+Healthcare+Global+Market+to+2026+-+Opportunity+Analysis+and+Industry+Forecast&utm_exec=jamu273cid